|

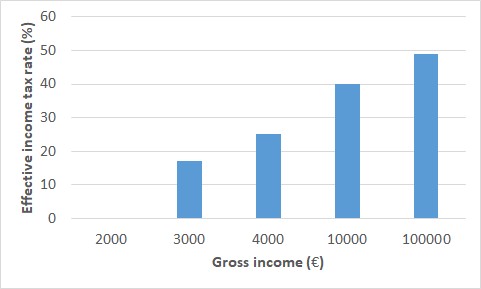

Figure 1. Proposed

relationship

between gross and net income.

|

Bring

Back Truly Progressive Taxation and Eliminate Poverty with

BI+CI: Basic

Income plus Constant Incentive

Richard

Parncutt

1985-2025 |

BI+CI

stands for Basic

Income plus

Constant Incentive (also called Basic Income and Flat Tax or BIFT). BI+CI

is

a promising approach to public economics that could solve

a long

series of

social,

political, and economic problems. Under

BI+CI,

- everyone

always receives a basic income (that is, the BI it is

universal and unconditional) and

- everyone

is motivated to work to the same degree (incentive is constant, hence

CI),

because everyone keeps the

same proportion of their additional earnings (the rate of tax

applied to additional earnings is constant).

BI+CI or

BICI is

pronounced bee-chee, like bici

(bike in Italian, short for bicicletta).

But BI+CI has nothing to do with bikes. In Chinese, bǐ cǐ means

"each other". The aim of BI+CI is to create a

society in which people look after each other, ensuring that no-one

falls into poverty while at the time motivating everyone to contribute

to society with work and ideas.

BI+CI

is perceived

differently by people on the political right and left. Which of

the following are you?

- If

you are politically conservative, you may be attracted by the idea

of

reducing the size and complexity of government, or simplifying

bureacracy. Both BI and CI would do that. You may also

worry about the implications of giving everyone BI. You may fear that

society

can't afford it or that people would

no longer want to work. We will return to these questions below.

- If you

sympathize with the political left, you may want to end poverty. BI

would do that. You

may realize that advances in technology and artificial

intelligence

are threatening jobs like never before, and see BI as a possible

solution. Conversely, you may be wondering why we invented all that

great technology without taking advantage of it to reduce working

hours. Surely advances in technology make it possible and reasonable

for many people not to work (in the sense of earning money) at

all? You

may want unemployment

offices to stop hassling and stigmatizing the unemployed and give them

more freedom to choose a job that suits their abilities and aspirations.

You may simply

want to make the rich pay -- to reduce the injustice of the rising

wealth gap. BI+CI would do all of that. But you may have a problem with

the flat income tax that creates CI (Constant Incentive).

A flat tax? Seriously?

BI+CI achieves constant incentive by taxing additional income (income

beyond BI) at a constant rate.

In other words, it includes a flat income tax.

For the purpose of

this article, I will assume

that BI is €1000

per month and CI is 50%. Everyone

gets €1000

per month and

everyone also keeps half of any additional income. Additional income is

effectively taxed at a flat rate of 50%. Expressed mathematically, the

income tax

rate is (1-CI).

Calls for "flat income tax" often come from the political right or

people

with high incomes who are trying to pay less tax. They are thinking of

something very different from BI+CI. They want a low income tax rate

that applies equally to everyone. Countries that have recently

implemented that include Russia, Hungary, Romania, and Bolivia. BI+CI

assumes a much higher flat tax rate, more like Greenland (45% according

to Investopedia).

Although a low, flat

income tax ostensibly treats everyone equally, in practice it allows the

rich to get

richer and the gap between rich and poor to

get wider. Mathematically, such a tax is neither progressive nor

regressive, but because it tends to increase the wealth gap, it is effectively

regressive.

That is catastrophic,

when you consider how the growth

of the billionaire class is undermining democracy.

BI+CI is different. If a relatively high, flat income

tax is combined with an unconditional basic income, the

result is implicitly

progressive: the

more you

earn (i.e., the

greater is your gross income), the higher is the proportion of your

gross income that you effectively

pay in tax (i.e., flat tax minus BI). This point is explained

in detail with examples below, in the section on implicit progressivity.

Readers who

doubt that flat tax can be progressive in that way are kindly asked to

read that section before continuing.

From

a left-wing viewpoint, a

flat income tax is either good or bad, depending

on

the context

in which it is

introduced. If there is no unconditional BI, flat income tax

is bad and should be avoided. But if flat income

tax is combined with an unconditional BI, as in BI+CI, it's a promising

left-wing idea.

Left-

versus right-wing approaches

to BI+CI

People on the political left and right approach BI+CI differently.

Which of the following are you?

- If

you identify with the right, you may worry that BI would give

people something for nothing. In fact, a

large proportion of wealth

is inherited, and depending on the tax system, most may be inherited (more).

That is, people

often get something for nothing -- especially if they are already well

off. Whether

you agree with that or not, you may still think that a BI would remove

the motivation to work. It is true that the motivation to work would

depend on the amount of the BI. If it was too high, many would choose

not to work. But with a relatively low rate

of BI the motivation to work depends more on the

relationship between increases

in work and increases

in

income -- that is, the gradient of the

function of net income against gross income (see Figure 1 above). That

being the case, BI, when combined

with CI to create BI+CI, would increase the

motivation to work for low income earners.

- If

you identify with the left, you may be worried that the proposed BI is

too low -- not enough to cover basic needs. But the unconditionality of

BI also has

value. Even with a relatively low BI, the combination of BI+CI

can

eliminate poverty. You may also be worried about "flat

tax" (the above

text may not have convinced you). No problem, we will return

to

both these points.

For

different

reasons, BI+CI may be rejected by both left and right.

Left-wingers may feel it is not progressive enough, if BI does

not

clearly and completely cover basic needs, or everyone has to pay income

tax. Right-wingers may fear some new kind of

socialism sneaking in by the back door. But BI+CI is

neither left nor right. Governments, voters, and economists would be

free to make BI+CI as left

or as right as they want. They would do that by adjusting two numbers:

BI, the rate of basic income for most people, and CI, the proportion of

additional income that all people take home.

A left-wing approach to

BI+CI has a high BI and a low CI, whereas a right-wing approach has a

low BI and a high CI.

- In

the extreme left-wing case, CI=0. But

that cannot

work, as we know from history of communism. With no financial

incentive to work, the BI can hardly be financed.

- In

the extreme right-wing case, BI=0. Some anarchists believe

we don't need any

government at all. Therefore, we don't need tax, so CI=100%. That would

mean the end of

civilization.

Amazing

but true: there are revolutionaries out there who actually

like those two alternatives. Thankfully, they represent a

tiny minority. In a functioning democracy, the vast majority find

themselves somewhere in the middle. If

BI was €1000/month

and CI was 50% -- if people could keep half of all additional

income, the other

half going to the government --

people on the left and right would

react

differently.

Those on the

left would want to raise BI and lower CI, while those on the right

would want to lower BI and raise CI.

In

that regard, BI+CI is

politically neutral, but in another way, BI+CI is biased toward the

left. It is

simpler and more transparent

than the current

system. That makes it easier for voters to understand, and harder for

populists to trick voters into voting against their

interests. Transparency is improved, which improves democracy.

Before continuing, I have a special request to the reader. Please

consider adopting a centrist

perspective -- neither left

nor right, or at least centre left

-- and asking yourself this

question: Given

that there are often good arguments on both the left and the right,

what kind of public economic system would be best for society as a

whole?

Contents

Three

impulsive responses

As

the gap between rich and poor

widens, a growing number of

people are

struggling with unemployment, precarity, or insufficient income. That's

not only bad for people -- it's also bad for the

economy, which relies on consumers with money to spend. Perhaps most

importantly in the long term, a large gap between rich and poor is bad

for democracy. It creates a large group of people who are angry and

disgruntled about the bad deal they are getting. Many of those people

end up voting for the far right. But the far right has no solutions

(the problem is certainly not caused by migration, for example), and if

the far right get into power, the

problem gets even worse.

BI+CI is a promising solution. But many have never heard of it. It is

not being seriously

discussed, let alone introduced. Many immediately

reject the idea and keep surfing. Here are some impulsive responses:

- Finance: "A

basic income would be

too expensive! We can't afford it!"

- Incentive: "With

a basic income,

nobody would want to work!"

- Equity:

"A system that treats

everyone equally would

favor the rich!"

In

all

three cases, the opposite is the case.

- Finance. A

BI is not too

expensive. The

state already

finances diverse social benefits. A BI can be

financed by redefining existing benefits, and by drawing

a straight

line through the current complex relationship between net income and

gross income (see Figure 1). Balancing

the books is then a

matter of adjusting the position and

gradient of the

line. Beyond

that, BI

can be financed by increasing government income. That can be done in

at least five ways: (i) increasing the income tax rate

(here: 50%, made

acceptable by the BI that

everyone

would get),

(ii) motivating everyone to work

(here, by applying CI = Constant Incentive), (iii) making it harder for

the

rich to

avoid tax (here: by making income tax flat and immediately payable),

(iv) introducing additional

taxes such as wealth, transaction, or environment taxes (which are in

any case urgently necessary to limit the widening wealth gap), and (v)

reducing the size of unemployment offices, which BI+CI largely render

obsolete. Seen in

this way, it

is the current system that is too expensive. Point (iii) is

especially relevant. Because

it is so

complex, the current system encourages

people to avoid or evade tax. The richer you

are, or the better your accountant is, the more tax you can avoid or

evade. The current system even motivates the unemployed not

to work by taking away their

benefit when they get a job (point ii). This welfare

trap is

the cause of diverse social and

economic problems, and BI+CI removes it.

- Incentive. It is worth repeating

that, for

the first time,

BI+CI would motivate everyone to work. The

line in Figure

1 is straight. No matter what your income is,

with BI+CI you always take home more if you work more. Moreover, you

always take home the same proportion of additional earnings. Motivation

to work is always positive and independent of income. It is the current

system that demotivates people.

The current system primarily

motivates people who

already

have a job to get a better one. If you

don't have a job, and

you are offered a part-time job

that pays hardly more than welfare, the current system motivates you to

stay on welfare. Unemployment offices often struggle with

long-term unemployed who refuse jobs that are offered to them. But

those people may be behaving in a perfectly rational way. In the

present system, the financial reward for taking a new part-time job is

often remarkably small when the loss of benefits is taken into account.

BI+CI solves the problem.

- Equity. BI+CI

treats everyone

equally, rich and poor, employed and unemployed. The system

includes two adjustable parameters, BI and CI, both of which

affect everyone equally. The wealth gap (gap between rich and poor) is

adjusted by adjusting the parameters. A small BI and a large CI lead to

a large wealth gap. A

large BI and a small CI lead to

a small wealth gap. This

simple, transparent feature

gives people more democratic control. Moreover, with

BI+CI it is no

longer possible to discriminate against a given group on the

basis

of their financial resources or lack thereof. Socioeconomic

discrimination or divitism

is prevented. It is

the current

system that is undermining equity.

The current system labels and

stigmatizes people as either working or unemployed, and treats these

two groups differently. People think that it is necessary to make this

distinction, but BI+CI shows it is not. From the perspective of BI+CI,

any deviation from a straight line in Figure 1 is a case of divitism:

discrimination on the basis of wealth or income.

The

three points can be understood by considering a simple example. Imagine

this scenario. You are

unemployed and dependent on a BI of €1000

per month. Hopefully more,

but the round figure is easy to work with.

- Finance. The BI

corresponds to minimum unemployment benefit or emergency assistance in

the present system. Additional

costs to the government

can be covered by raising

income tax, motivating

everyone to work regardless of income (CI), collecting income tax

immediately and without deductions

(flat tax), and/or additional taxes (wealth, transaction, environment).

- Incentive. Analyzing

your private situation, let's suppose that of the €1000

you receive

each month,

€800

is for fixed, unavoidable expenses: cheap

rent, cheap food, cheap transport. You have only

€200

to spend as

you choose. Now suppose you are offered a half-time job that pays €1000

gross. In the

current system, you would lose your benefit, and your net income would

stay

the same. You would effectively be working for nothing. Why take such a

job? With

BI+CI as shown in Figure 1, you would take home €500

extra per

month (50% of €1000).

The amount you

had left after paying unavoidable

bills would rise from €200

to €700.

Of course you

would take the job. In this case, BI+CI motivates you to work, whereas

the present system motivates you to stay on welfare.

- Equity. With

BI+CI, welfare and

tax offices would not treat you any differently from anyone else.

Despite your low income, no welfare office would be telling

you what to

do. No one would treat you like a failure or interfere in your private

affairs. No one would imply

that poverty is the "fault of the poor". Instead, the tax office would

make sure you pay

your taxes like anyone else.

Understanding

Figure 1

Figure 1 is

a

proposal for

the relationship between gross income

and net

income for

individuals. These two terms are

being used in a special way:

- Gross

income (the

horizontal axis of Figure 1) is

income before

welfare and/or income tax (or before BI+CI).

- Net

income (the

vertical axis)

is income after

welfare and/or income tax (or after BI+CI).

Therefore,

- Net

income = Welfare

(BI) + Gross

income - Income tax

or

more simply:

- Net

income = Welfare

(BI) + Constant Incentive

(CI)

In

modern democracies, in which most

people identify with the middle class, income tax is the government's

main

source of income. The

rate of income tax collected

within BI+CI is (1-CI). For the purpose of argument, I will assume that

CI = 50%. The income tax rate, therefore, is 1-50% = 50%. The rate

needs to be relatively high to finance free health

services, minimum pensions, and other social

services of all kinds, as well as the BI and the cost of running of

government.

The

diagonal line on Figure 1 basically says two things:

- No

matter how much you earn (gross income), the government gives you the

same BI at a rate near the

poverty

line. The BI is universal

(everyone receives it)

and unconditional

(the

amount is independent of any other income).

- No

matter how much you earn (gross

income), you take home the same proportion of your additional earnings

(CI).

Figure

1

illustrates three additional features of BI+CI:

- There

is only one line. Welfare and

income tax are combined into a

single, simple system.

- The line is

straight. The more you work,

the more money you take home. The proportion of your income

that you

take home is always the same. The intrinsic divitism

of the current system is eliminated.

- The

line does not go through the origin.

It crosses the vertical

axis at a point near the poverty line.

That eliminates

poverty and makes income tax implicitly

progressive. Poverty

is eliminated, even if BI is slightly below the poverty line,

because people are free to earn extra income

without

returning the BI, in whole or in part.

BI+CI

is an inseparable combination

of BI and CI.

BI

cannot be

changed without changing CI and vice-versa. It

can therefore

be

misleading to consider BI alone (as right-wing critics do, when they

complain about giving people something for nothing), or CI alone (as

left-wing critics do,

when they complain about "flat tax"). The

line on Figure 1 shows the combined effect of BI and CI.

That is

all that

matters. As

Frank Sinatra crooned: "Love and marriage go together like a horse and

carriage".

- BI needs CI. The

BI has to be financed. CI would be the main source of that

finance.

- CI needs BI. The

flat tax implied by CI is only progressive if it is inseparably

combined with BI.

Initial

estimates of BI and

CI

For the purpose of this text, I

have

chosen round figures to

simplify the calculations:

BI = €1000/month

and CI = 50%. (BI is the unconditional basic income, and CI is the

proportion of additional earnings that people keep -- their Constant

Incentive.) If BI+CI were

implemented, these values would need to be

adjusted.

- The

political left would want to raise BI, but that may mean reducing CI,

which the right would not like. Conversely, the right would want to

raise CI, but that generally means reducing BI, and the left would

object.

- A

BI of €1000/month

would

be comparable with current "emergency unemployment assistance" (Notstandshilfe)

in

Austria. The

right

would ask whether €1000/month

is too much for a handout that everyone gets, no questions asked? An

appropriate answer is that BI+CI would motivate

people to

work

more than the current system does, knowing that no

matter what kind of work they chose or how much they earned, working

more would

always increase their net income, because they would

never lose the BI.

In that way, the effective unemployment rate

would fall. With more people working, government income from income tax

would rise, helping to fund the BI.

- The

proposed rate of 50% for CI corresponds to an income tax

rate of 50%. That seems like a psychological

limit that should never be exceeded. For the political right, it would

be too much; for the left, too little, if more income was

needed to finance a higher BI. But

recall that in exchange

for 50% income tax everyone would be getting the BI. That's a great

deal -- nothing like it ever

happened

before. No one would ever fall into poverty, no

matter what bad decisions they made or what kind of

bad luck they had. At the same time, people could still become as rich

as they wanted. No matter how much they earned -- the more they earned,

the

more money they could take home.

- The

left would point out that €1000/month is

not

enough to live on in

a rich country. Given

the

rising cost of living, a BI of €1200

or even €1500 per

month, would

be preferable -- comparable

with

typical unemployment benefits in Austria or the

EU's risk

of poverty threshold. But

adjusting one of the two values

(BI and CI) would mean adjusting the

other. If

BI was raised from

€1000

to €1200,

and CI was held at 50%, the net income of a person earning €4000

gross would go up from €3000

to €3200.

The tax effectively paid by that person would fall from €1000

to €800.

Across the board, such changes would mean serious loss of

taxation

income. To

solve this problem, either CI would have to fall

below 50% (which the right would hardly accept) or other taxes would

be needed.

- Besides

income tax, other possible taxes

include wealth,

inheritance, transaction, and

environment (carbon). Such taxes are in any case urgently needed to

preserve democracy by reducing the wealth gap, but political

introduction is difficult (more).

Most parties are reluctant to push for

wealth taxes, the main exceptions being left-leaning politicians within

centre-left parties (e.g., Bernie Sanders). It seems unrealistic to

count on new wealth taxes being introduced any

time soon (although a discussion about BI+CI might provide the

necessary

impetus).

- Instead

of increasing BI, one might invest in universal

basic services --- free or

subsidized public services such as

water, education, internet, public transport, health care, housing with

electricity and heating/cooling, basic food, legal aid, and banking.

The more such services are available, the lower the BI can be. Of

course, that would also require more taxation income.

Given these complexities, I

will stick for the moment with round

figures, BI

= €1000/month

and CI = 50%, to show how BI+CI

would work. The

point is to get

the general idea accepted first

(in particular, the idea of unconditional

BI) and adjust the numbers later.

Special

cases

This text

focuses on the average person, but there are important exceptions,

which apply throughout this text:

- Parents

would

receive BI for their children -- at a lower,

age-dependent rate -- in addition to their own BI.

- People

with relevant disabilities

(those that prevent them from working or earning money at the same

level as others) would receive a higher rate of

BI.

- Foreigners

would

receive a lower rate of BI, depending on their immigration status.

- Pensioners

would receive BI corresponding to the minimum

pension plus additional benefits from private pension funds.

Individual

adjustments of BI should be kept to a

minimum, to ensure that the system is perceived as fair, and to

minimize administrative costs. The four listed categories are clearly

defined, and clear tests can be devised to consistently decide the BI

in each case. Special

BI rates should be determined by a

politically neutral and independent process that prevents political

parties from favoring their clients.

Let's assume for the sake of argument that children

receive half of

the standard BI. If BI was €1000,

a

single parent with one child under 18 years would receive €1500

plus the freedom to earn any amount of additional money without losing

the BI. A single parent with two children would receive €2000.

One

case in which this could really help people is domestic

violence. BI+CI would enable a mother with one or more children to

leave

a violent partner behind

and live independently.

The

BI would correspond to the minimum pension. Like other government

expenses, the minimum pension would mainly be financed by income tax.

Workers

would be free to

make regular contributions to additional pension or superannuation

funds, as they do today.

Implicit

progressivity

Today's

tax systems are explicitly

progressive: the more you earn, the more

income tax you pay as a percentage of

all earned income. For example, you may pay no tax in the lowest income

bracket, 20% in the next, 35% in a medium bracket, and 50% in

a

high bracket.

BI+CI is implicitly

progressive. The explicit tax rate is always the same (1-CI), but

because that is inseparably combined with BI, the implicit tax rate

rises

steadily with increasing income. The more

you earn, the

greater proportion of your gross income is

effectively paid in tax.

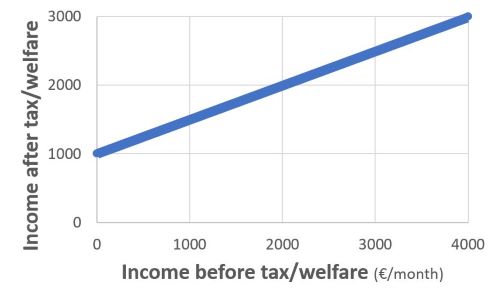

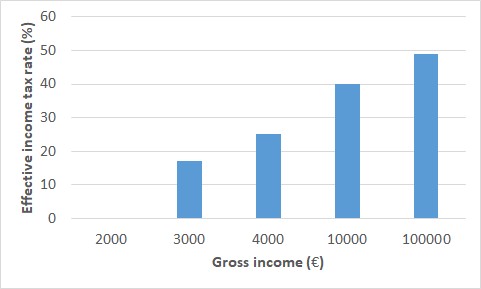

The

implicit progressivity of BI+CI is illustrated in Figure 2.

Assuming that BI = €1000

and CI = 50%, the

effective tax rate is zero for gross incomes below €2000.

Above

that, as gross income

increases, the effective tax rate increases as shown. The effective tax

rate

approaches but never reaches the flat rate of income tax (here, 50%).

Figure

2. Implicit

progressivity of BI+CI with BI

= €1000/month

and CI =

50%.

Figure 2 can be understood by referring back to Figure 1. Here is now

the

effective tax rate increases:

- If

your monthly

income before

tax/welfare

is €3000,

you take home €2500. That's €1000

in BI

plus €1500

in earnings

after tax (half of €3000).

Effectively,

you pay €500

in tax (€3000

- €2500),

which is 17%

of €3000.

- If

your monthly

income before

tax/welfare

is €4000,

you

keep

€3000 and effectively pay 25%

tax.

- If

your monthly

income before

tax/welfare

is

€10,000, you keep €6,000.

The tax

rate is

effectively 40%.

- If

your monthly

income before

tax/welfare

is €100,000,

you keep €51,000.

The effective tax rate has

risen to 49%.

BI+CI

solves the problem of bracket

creep, a form of fiscal drag

or

kalte Progression.

In the present system, when inflation pushes wages and salaries into

higher tax brackets, the

effective tax rate increases although real earnings remain

constant. The

problem is addressed by adjusting the boundaries between

tax brackets for inflation. In BI+CI, there are no tax brackets, and

the

problem of bracket creep does not arise.

The

above cases are for higher

income earners. BI+CI is also implicitly progressive with respect

to lower income earners. For them, the benefit that they are effectively

receiving falls as

their income rises, and it does so gradually and continuously:

- If

your monthly income before tax/welfare is zero,

you receive €1000

per month.

- If

your monthly

gross income before

tax/welfare

is €1000, your net income after tax/welfare is €1500.

That's €1000

BI plus €500

CI. Your

effective

benefit has fallen

to €500.

- If

your monthly

gross income is €2000, your net

income is the

same: €1000

BI plus €1000

CI. Your

benefit

effectively is effectively zero, as is the effective tax

rate. That

is called the break-even point,

and

it corresponds

roughly to the minimum

full-time

wage. If

you are earning less, you are effectively receiving benefits. If you

are earning more, you are effectively paying tax. But nothing special

happens when you pass this point -- the transition is

smooth.

Regarding

the second case above, with gross income =

€1000 and net income =

€1500,

it is

worth repeating

that BI+CI is always

effectively progressive -- unlike the present system. The most dramatic

departure

from progressivity in the present system happens when the unemployed

get a part-time job or "side hustle" and their extra income exceeds the

threshold for being defined as unemployed. In Austria it's called the

marginal earnings threshold or Geringfügigkeitsgrenze.

When you

hit this limit, the system suddenly becomes regressive. As your income

increases, your benefit is cut, either suddenly or gradually. The more

you earn, the more your benefit is cut. If tax is defined as

loss

of a marginal increase in income, you are effectively paying a high tax

rate. For many, it is not worth taking a part-time job. It's called the

welfare trap. With BI+CI, this problem disappears.

Flat

tax? Really?

Despite this demonstration of implicit progressivity, commentators on

the left may still

complain that BI+CI includes a flat

tax. The term has a bad

reputation.

Some conservative and far-right voters advocate flat income

tax, arguing that it's unfair to ask the rich to pay higher rates of

income tax, as in progressive tax systems. Of course, those folks are

not also advocating an unconditional BI. A flat tax of the kind that

they want makes the rich even richer and

the poor even poorer.

Current

income tax

regimes attempt to solve this problem by writing

progressivity into taxation law. In

other words, progressivity is

explicit. Richer

people pay

a higher proportion of

their income back in tax. That is supposed to stop the wealth gap

between rich and poor from getting bigger. Unfortunately, it is not

working. The wealth gap has been rising for decades.

In BI+CI, the expression "flat tax" has a different meaning. It

is part of a

system that is always implicitly

progressive. The degree of

progressivity

depends on how the two

parameters, BI and CI, are set. The bigger the BI (or the smaller the

CI), the more

implicitly progressive the taxation becomes (and

the more left-wing). The smaller the BI (or the bigger the CI), the

less progressive (and

the more right-wing). The progressivity of the system can be

adjusted to

stop the wealth gap from widening.

Financing

BI

Many oppose BI because they think

it would be too expensive.

In

fact, BI+CI

would require no additional funding, if the line on Figure 1 was

a

line of best fit through the existing complex relationship between net

and gross income. It's a matter of

adjusting BI and CI to balance the books.

By simplying income tax, BI+CI would make income tax harder to avoid.

Since all

income would be taxed at the same rate, the tax could often be

collected immediately, without waiting until the end of the year. That

would increase tax income for the government, helping the BI to be

financed.

Some have discussed financing BI with consumption taxes (e.g.,

VAT, Mehrwertssteuer).

That is

problematic if consumption taxes hurt the

poor more than

the rich. But in countries where consumption taxes are already quite

high, it may be pragmatic for consumption taxes to contribute to

financing BI within BI+CI. They at least represent a stable and

reliable

source of income.

Guy

Standing has proposed a basic

income scheme underwritten by

taxation on the rich. I am all in favor of wealth taxes. As the wealth

gap between rich and poor widens and the number of billionaires

increases, wealth taxes become all the more urgent. But I don't think

BI should depend too much on wealth taxes, because they are politically

unreliable. Whenever the government moves to the right, they risk being

cut. For BI to work, it needs a strong foundation. Income tax is

traditionally the biggest

and most reliable source of state income.

BI supporters have also considered financing the BI with inheritance

taxes, transaction

taxes, and carbon taxes. We need more of all of those, to

reduce the wealth gap, and all can contribute to BI. Modern Monetary

Theory may also be relevant so this discussion.

But once we realize that BI+CI can finance itself, such discussions

become unnecessary distractions. The point is to implement BI in the

existing system.

The objection that "BI+CI would be too expensive" is problematic in

another way. Humanity has never been richer. There are about 3000

billionaires in the world, with a total wealth of $15 tn. If they paid

normal and fair amounts of tax, there would be plenty of money for any

beneficial project. The problem is not the expense -- it's the failure

of governments to tax the rich fairly (or at all, in many cases).

Transparency

and democracy

The

present tax/welfare system is conservative, treating the

unemployed like second- and third-class citizens merely because

they lost their job, while at the same time making it easy for the rich

to avoid tax. By labeling and stigmatizing the unemployed, the system

invites the employed to blame the "lazy" unemployed for the country's

woes, whatever they may be. That causes all kinds of anger and

frustration, leading to violence and far-right

politics.

The current system is also complex. So much so, that no-one understands

all the details and possibilities. People often think

there must be a good reason for that, but there

is not. The

current system

is complex for two bad reasons:

- Generations

of

politicians

have added details in an attempt to impress specific groups of voters.

- Generations

of rich people have employed smart, expensive accountants to find

loopholes in taxation law that enable them to evade tax.

With BI+CI,

neither of those two strategies would be possible. The system could

only be changed or adjusted along one axis, from left wing to right

wing. Left-wingers would push for more BI and less CI, and

right-wingers would push for the opposite. In that way, BI+CI

would

be more democratic: more transparent

and therefore easier for voters to understand. Democracy only works if

people understand what they are voting for! In that way, BI+CI would

benefit the left.

Think about the complexity of tax and welfare systems

and how that relates to transparency, fairness, and democracy.

Both

tax and welfare are

currently so complicated that large numbers of bureaucrats and

accountants are needed to understand and administer them. Like

specialist surgeons that understand only one part of the body, experts

in tax or welfare are typically responsible for only one part of the

system and have trouble seeing the big picture.

That gives the rich an

advantage. They pay accountants to exploit the system's

complexity, finding loopholes that will enable them to evade or avoid

tax. The implications are enormous. The accountants of the rich are

constantly reducing their tax bills and depriving governments of

revenue. They do this in both legal and illegal ways. The rich can

easily succeed in this game. For

the middle classes, it's not so easy. Their accountants are more honest

or less clever. The poor have no chance at

all. They can't afford accountants.

The

rich

benefit from

systemic complexity.

The solution is not to give everyone a free accountant. The solution is

to simplify the system. That should be a central left-wing

agenda.

Astonishingly, it is not.

Are we

so used

to the complexity and opacity of

both welfare and tax that we forget what a simple system would

be

like?

Relative to the current system, a simpler system would be

more democratic, and in that sense more left-wing. But if BI+CI

was introduced, people of all political

colors would soon

get used to it and eventually regard it as normal, wondering how we

survived so long with the previous, crazy system. Many

conservatives would like BI+CI because it reduces bureaucracy and

government interference -- consistent with conservative calls for small

government.

Sometimes

the left is its own

worst enemy. Left-wingers of different

kinds struggle with each other, allowing the right to swoop in and win

the next election. We cannot let that happen in the case of BI. The

task of eliminating poverty and creating a caring society is too

important. To overcome the right's stubborn resistance, which will

always be there, we need to unify the left; and the left needs

to

understand BI+CI.

Paradoxically, BI-CI is often misunderstood despite its simplicity.

That

is because it turns the current system on its head. Instead of giving

people benefits because they are desperate, it gives everyone the same

benefit. Instead of taxing people because they have a good income, it

taxes everyone. In that way, everyone is respected.

Paradoxically, in the end people on lower incomes are better off.

Unfortunately,

many people refuse to believe that a system of welfare and taxation

could be either simple or fair, let alone both at the same time. It's

understandable. We

are so used to the

current complicated system that we have lost the ability to

appreciate the benefits of simplicity and clarity. We have forgotten

what it is like to actually understand how the system works.

For a change, BI+CI is not a trick. It is too simple for that. Its

power

lies in its simplicity. Nor is BI+CI politically left or

right. It

is politically neutral. It

is a new foundation for productive, fair collaboration between

left and right. Whereas the most immediate benefits would be felt on

the left as poverty was effectively eliminated, the right would also

benefit from improved long-term financial stability.

Democratic

adjustment

of BI and CI

The

rates of BI and CI in Figure 1 are only for

illustration. The

exact values would be determined in

a democratic political process. Socialists would prefer a

higher BI and a higher income tax rate to finance it.

Capitalists would

prefer a lower BI and a lower income tax rate. The two groups would

meet

somewhere in the

middle. The

result would be fairer and

more transparent than the current system.

Today,

people

without the

privilege of a good education are often tricked into voting

conservative by privately owned media. Worse, they are tricked into

voting far right by misleading or dishonest claims by populists. BI+CI

would make

it

harder for politicians to trick the electorate, because it would

be easier to

predict the consequences

of changes in tax and welfare. People would understand better what they

were

voting for.

They would be in a better

decision to make informed decisions

and act in their self-interest. For that reason, the

balance of power would shift toward the left,

improving

the balance between left- and

right-wing politics. That

could allow

the BI to be increased gradually

after being introduced, eliminating poverty.

The

government would roughly balance

the books, paying out the same amount in BI as it receives in income

tax plus other sources of income. (In

reality, things are not that simple. But for the

purpose of argument it's a reasonable assumption. Economic stability is

an important factor.) That

being the case, how much BI

is the right amount?

The

political left would argue

for a relatively high BI that lifts everyone out of

poverty: higher

than usual

measures

of the

poverty line, or the minimum benefit currently

received by the long-term unemployed. The political right would argue

for a lower BI that forces people to work at least a few hours per week

to make ends meet. Perhaps the truth lies between these two

approaches?

A relatively high BI might be justified if it was much less than gross

national

product divided

by the (adult) population. But a

high BI could have enormous political and

macroeconomic

consequences. The history of economic revolutions and radical reforms

teaches us that it is better to change the political and economic

landscape gradually, to encourage stability and avoid any

future backlash.

Besides, in a democracy, BI can only be

introduced if a majority of

people agree with it. If the amount being proposed seems to high, BI

won't happen. Unfortunately, many fear that BI will make

people

lazy -- especially if it is relatively high. Those people are

unlikely to change their minds until they see with their own

eyes that BI+CI motivates everyone to work regardless of income.

BI should meet a person's "basic needs", but

estimates of those costs vary. A BI that is slightly below the poverty

line (however defined), or the minimum total benefit usually received

by the long-term

unemployed, would be acceptable if, for the first time,

unemployed or unwaged people were free

to supplement their benefit

for a few hours or a couple of days per week without losing any of it:

- Extra

income would be taxed, but that tax burden would be smaller than

the burden of losing some or all of unemployment benefit in the current

system.

- The

freedom to earn money without losing BI has monetary

value. Let's say its value lies

between 10% and 30% of BI. Perhaps 20% is a reasonable figure?

That being the case, if the poverty line is €1300,

the BI should

be €1100.

From this viewpoint, the

current system is giving low income

earners (e.g.,

casual and part-time workers) a

bad deal.

It's no wonder those who are earning little more than

the unemployment

benefit (which they have therefore lost) are struggling. BI+CI would

improve their situation even if BI remained below the poverty line.

Now

imagine a

situation where BI+CI is being planned and initial levels of BI and CI

are being discussed. People are arguing that the present system should

be maintained as far as possible because of its long history.

Besides, they argue, it is not reasonable, and politically dangerous,

to take money away from some and give it to others. Therefore the

straight line

in Figure 1 should be bent here and there to make BI+CI more like the

present system.

Such arguments are misleading. Unlike the current system, BI+CI is

intrinsically fair, because it treats everyone equally. It gives

everyone the same BI (apart from the listed exceptions) and the same

proportion of earned income (CI). Combining these two features

(one of which is considered fair by the left, the other by the right)

creates a system in which people with lower incomes are better off (to

the surprise of those who previously thought "flat tax" was always a

bad thing). The intrinsic fairness of BI+CI makes it clear that people

with lower incomes should

be

better off than they are now. In this way, BI+CI allows us to discover

unfairness in the present system, and correct it.

Here are some other ways in which people might want to bend the

straight line in Figure 1:

- The

left might argue that the marginal tax rate should increase as income

increases. But BI+CI is

already

inherently progressive, and that progressivity can be increased or

decreased simply by adjusting BI and CI. Instead of bending the line,

left-wing goals can be achieved by raising BI and lowering

CI for

everyone.

- Similarly,

the right might argue that the marginal tax rate should decrease as

income increases. After all, they might argue, if the rich have to pay

50% in income tax, won't that reduce competitivity or cause capital

flight? But within BI+CI the goals of the right can be achieved by

reducing BI and increasing CI. Again, there is

no need to bend the line.

Life

would be simpler, and the system would maintain its transparency, if

the line in Figure 1 was

kept straight by law. That would prevent such misleading discussions

from

even starting.

The

end of tax deductions

In

the current

system, income earners typically pay tax on their income throughout the

year. At

the end of the year, they submit a claim for a tax return. The final

amount of tax paid depends on this yearly statement. The claim includes

expenses incurred when earning income, which are

often deducted from income.

People love tax deductions because

they reduce their tax bill. The

trouble is, tax deductions also reduce the tax bill of the rich, and

the rich typically save more money this way. The

richer you are, the more you can pay accountants to dream up brilliant

tax deduction schemes. The richer you are, the more you can invest in

your business -- your

means of production. In

the end, the current system of tax

deductions means that people with low or medium incomes pay

more

tax relative to the rich.

If

I want to teach the

piano, it is my problem to buy the piano for the lessons. It is my

business to estimate the risk, not the government's. Banks are

available to lend me the money and it is their problem to decide

whether I am likely to pay the money back or not. If the government

wants to promote

piano teaching for political reasons, they can give me a subsidy.

Under

BI+CI, one might

realistically imagine a world with no tax

deductions, no tax statements, and no tax returns for most

people. This radical simplification, which would benefit the

poor

more than the rich, is possible because both BI

and CI

involve flat rates. It would no longer be necessary to wait until the

end of the year to calculate your tax. More often than that (probably

every month) there would be an electronic financial transaction between

each individual and the government. Those on low incomes would receive

money and those on high incomes would pay. The amount would be

calculated according to Figure 1. Each transaction

would be

closed and complete.

BI+CI

would be introduced in

stages, in a transition period (see below). During that same time,

tax deductions

could be gradually phased out -- just as governments

currently change which expenses count as deductions

and which do not (more).

The

end of cash

BI+CI assumes that all income is taxed. For BI+CI to work fairly, all

income must be declared. A possible way to achieve that is to make it

illegal to pay by cash in exchange for work. To receive any income,

whether BI or wages, it would be necessary to open a bank account and

receive the money by appropriately labeled bank transfer. Going even

further, BI+CI might work best in a cashless society in which all

financial exchanges are electronically recorded.

That raises well-known issues of privacy and centralized control. But a

cashless economy also has advantages: reduced business costs, less tax

evasion, less money laundering (more).

Getting

rid of

cash might even reduce

transmission of disease (on dirty banknotes). The

world seems in any case to be moving in the direction of a cashless

economy, so let's see how that develops.

Why

BI+CI is good

In

the interests of long-term stability, BI+CI

would fulfill the following four criteria proposed by Georg

Quaas in 2017:

- Existing

work incentives would be maintained

and improved.

- Social

security would not be completely

restructured (risky

experiments would be avoided).

- For

the same reason, the reform would, in the

end, simplify the

system.

- The

additional tax burden for higher income

earners would be

perceived as acceptable.

The

transition to BI+CI

Public economic systems are complex and their many elements can

interact in unpredictable ways. The path toward BI+CI should

therefore be taken in relatively small steps, each time waiting for a

new equilibrium to be established. Changes that are unnecessarily large

or fast should be avoided.

The first step might be to draw a line of best fit through the current

relationship between gross and net income such that the net income of

low income earners slightly increased and that of high income

earners slightly fell. In this first stage, the BI would be

relatively small. It would be subtracted from existing benefits so that

for most receivers the total benefit would remained unchanged.

The BI would then be increased in a series of steps, each time reducing

or

eliminating corresponding benefits and adjusting

CI to balance the

national budget. The goal would be to

eliminate poverty by gradually increasing BI to the poverty line,

however defined. That way, the incentive to work would be maintained.

At every step toward BI+CI, the relationship between the supply and

demand of labor

would change. Inflation might increase for two reasons:

- People

on low incomes would be under

less pressure to accept uninteresting job offers (especially in the

case of part-time work). Employers would need to offer higher wages

for those jobs. That

would increase production

costs, which in turn

would increase prices. At the same time, unemployment would increase.

- The

average person would have more

money to spend. There

would be no more "working

poor"; those

who had previously fallen into that category would be able to afford to

pay more for basic goods and services.

BI+CI

would reduce the wealth gap: whereas poorer people

would have more money to spend, richer people would have less. If that

relationship was carefully managed, the effect on inflation would be

small or negligible.

Inflation could be reduced by increasing interest rates to limit the

rate of private borrowing.

Gradually, new stable relationships between inflation and

employment would

emerge. Unemployment would no longer be the problem that it

is today, because it would no longer be linked to poverty. It would

become more difficult to measure unemployment because more people would

work part-time and there would be more flexibility in the duration of

part-time work.

A

vision for a better world

As

the world lurches from one

crisis to the next, and the number

of billionaires steadily increases, undermining democracy, many are

talking about reforming capitalism to make it

sustainable. But people have different ideas about how to do that.

On the one hand, we need globally

harmonized wealth taxes. That

could stop the rich moving their

wealth internationally to avoid tax. That should be clear. But we also

need to reform public economics, to improve quality of life

for all people, regardless of wealth. That means reforming the way

income is taxed, and reforming the way welfare payments are

distributed.

In

"Marx in Soho: A Play on

History", Howard Zinn proposed:

"Give people what they need: food, medicine, clean air, pure water,

trees and grass, pleasant homes to live in, some hours of work, more

hours of leisure. Don't ask who deserves it. Every human being deserves

it." BI+CI is a way of making that happen in a practical and

sustainable

way.

Imagine achieving all of the following social goals,

simultaneously:

- Poverty:

End

it at last, and for everyone: children, disabled, single parents,

unemployed.

- The wealth

gap

(difference between rich and poor):

Reduce it. Improve democracy.

- The gender

gap

(difference between male and female incomes):

Reduce it. Weaken patriarchy.

- The incentive

to work:

Increase it across the board. Make work more enjoyable.

- The freedom

to work

as little or as much as you want:

Improve it. Achieve true "freedom".

- Working

conditions:

Improve them. Give workers more bargaining power.

- Government

subsidies: Reduce

or eliminate them. For example, farmers may no longer need them.

- Technological

unemployment due

to robots

and artificial intelligence:

Alleviate it. Enjoy new tech

without fear.

- Meaningless

bureaucracy and invasion of privacy by tax/welfare offices: Reduce

it. Leave people alone.

- Irrational

behaviors

(crime or creating unpayable debts): Reduce them. Promote personal

responsibility.

- Cheating the

system,

including tax evasion and welfare fraud: Reduce

it. Make people more honest.

- Extremist

politics and

political violence, especially the far right: Reduce

it. Less desperation, more common sense.

- Democracy

(people

power!): Improve it. Bring it

back.

- Big global

problems

such as climate change: Solve

them faster.

A similar list was presented

by Guy Standing in his book "Battling

Eight Giants: Basic Income Now" (London: Bloomsbury, 2020). He argued

that basic income (more than other possible social policies) would

address inequality, insecurity, debt, stress, precarity, automation,

populism, and extinction.

The government of any country in the world

could achieve all these points by replacing their current complex

welfare and explicitly progressive income tax systems by BI+CI. That

may

seem like a wild, exaggerated claim; but I am not aware of any good

counterargument.

Besides, BI+CI has never happened before.

The best way to test BI+CI is to introduce

it and monitor progress.

Going

back in time, it was hard to imagine

the French revolution before it happened, or the vote for women, or the

universal declaration of human rights. But today, after these important

historical developments, we take them for granted and consider them

essential. We have no intention of going back to a world without

freedom, equality, and solidarity, or without equal rights for women,

or without human rights.

Now, imagine a world in which we take

it for granted that

poverty has been eliminated and will never come back. The real

possibility of introducing a universal BI means that a

world of that kind is now possible. So there is no longer any

particular reason why we should not

decide to achieve it. It could merely be a matter of attitude! Imagine

that.

If

the tax-welfare system were

radically simplified and BI+CI were introduced, we could achieve:

- The

end of poverty:

BI

would be a little below the poverty line, and people could

easily

supplement it with additional work. That would effectively end poverty.

- A smaller

wealth

gap: The income of lower

earners would increase. At the same

time, tax evasion and avoidance would be prevented, increasing tax paid

by higher earners.

- A smaller

gender

gap: Women more

often work part-time. With BI+CI, that work would become more

worthwhile. Women are also

more likely to receive and manage benefits for children. Those benefits

would increase. Beyond that, it would become easier to organise

feminist families in which old gender roles (childcare, money earning,

and so on) were more equally shared. Beyond infancy, parenting could

become equal and both both parents could work part

time.

- Universal

work

incentive: Welfare traps

would disappear. People would no

longer lose benefits as their income increased. The motivation

to

work would be constant and independent of income.

- Better

working

conditions: A BI would give

workers more bargaining power. They would be freer to

leave any

job. From that more solid foundation, they could put employers under

more

pressure to offer good wages and working conditions.

- More personal

freedom:

People would be free to work as much or

as little as they wanted.

Fear and stigmatisation of

unemployment would disappear.

- More rational

behavior. BI

experiments show that people on BI are more likely to educate

themselves and take entrepreneurial risks. They save more money, spend

less on healthcare, and commit fewer crimes (including domestic

violence).

- Less

meaningless

bureaucracy. Tax and welfare

offices would no longer invade

people's privacy. The system would be more efficient and

less wasteful.

- Less cheating:

It would be harder to cheat either the welfare or the tax system. There

would be fewer legal loopholes for the accountants of the rich to

explore.

- A weaker

far

right: There would be fewer

deeply

dissatisfied citizens, for populist

politicians to prey on. Corporate-controlled media would have fewer

gullible

victims. There would be

less injustice, hence less anger, and less violence. Life for

politicians, journalists, and activists would become safer.

- More democracy:

The system would be simpler and more transparent. Voters would have a

better understanding of what they are voting for at elections. The

political

power of democratically elected governments would increase relative to

that of corporations.

- Fewer global

problems. The revival of

democracy would make it easier to

solve big problems like climate change.

Can a single idea be

that good? Some suspect not, but that is

not

a good argument. A good argument is one that engages with the specific

issues, such as those just listed.

Beyond

the listed points, BI+CI

would

bring the usual, well-known benefits of

BI.

- BI

would enable people to train

themselves, which would improve the skills and motivation of

the

workforce.

- BI

would empower people to refuse inappropriate

or dangerous

work,

improving quality of life and reducing the cost of medical

care.

- BI

would enable people to travel to a new

location to apply for a

different

kind of job that better suits their preferences and skills.

- BI

would help

discriminated minorities establish themselves politically and

culturally.

- BI

would pay voluntary domestic carers of

children, the aged, and

the

disabled for their valuable work.

- BI

would reduce the incidence of domestic

violence by reducing the financial stress that contributes to conflict.

It would also empower victims of domestic violence to escape from

difficult

situations.

- BI

would help people in all walks of life to

think clearly about

their situation and solve their problems in a rational manner.

Myths

about BI

These points allow us to revisit a series of common myths about BI.

- Myth

no. 1. BI makes people

lazy. The

truth: The current system

makes people lazy.

In

the current system, if

you are unemployed, you get unemployment benefit. Usually, it is not

enough to live on. That is because the rich are trying to keep the

benefit low. Their logic: If the benefit was too high, you would not be

motivated to

accept poorly paid jobs, and the rich could not get people to work for

them (at least, not for the low wages they would like to pay).

Even if the

rich were feeling generous, poverty would not necessarily be eliminated

by raising the benefit, because that would reduce the motivation to

work and hence the amount of work that gets done, with negative

economic consequences. If you are on unemployment benefit and get a

chance to earn a small amount of money, the money is

deducted from your benefit. So there is no point doing that work!

That's why the unemployed often refuse job offers. It's called the welfare trap.

BI+CI solves

this problem by turning the system on its head, as shown in the figure

above. Under BI+CI, no matter how much

money you have to spend every month, the amount goes up

if you do extra paid work. In this way, BI+CI motivates

people to work

more, regardless of their current income.

- Myth

no. 2. We can't afford BI.

The truth: We

can't afford the

current system.

BI+CI

would radically

reduce the waste that is inherent in the present system.

An

example of waste is the money paid to employment

officers to monitor recipients of unemployment benefits. (Are the

welfare recipients

really looking for work? Are they attending job interviews?) BI+CI

shows

that

this monitoring work is unnecessary.

There

is

also a tax problem. The rich

often pay little or no tax. They

achieve that by playing with loopholes and international differences in

taxation law. Governments typically lose much more in tax evasion

(including

international tax havens) than in welfare

fraud (more).

The solution is to require everyone to pay fair amounts of

tax. A simple, transparent approach like BI+CI makes that easier to

achieve.

BI+CI

could unleash an unprecedented surge

of individual creativity. For the first time,

people would be free to

choose what kind of work they do. As long as that is not happening, an

enormous amount of human potential is going to waste.

Besides,

there is

plenty of money.

Humanity

has never been so rich, and the

rich are hoarding

unimaginably enormous amounts. There

are 2000

billionaires and 50

million millionaires in today's world, and both groups are

growing

steadily. Governments just need to tax them in a normal way

and

distribute the wealth a little more fairly.

- Myth

no. 3. You

have to work for every bit of money that you get. The

truth: That

cannot possibly work.

No

society works that way.

Many

people work for no money, and their work is absolutely

essential. Without them, the system would collapse. Some are looking

after other people: children, the elderly, the

disabled. These "carers" are more often women than men, which explains

why women have less money than men on average, and more often live in

poverty. Others are educating themselves (e.g., school children).

Unemployment

is inherent in today's economic systems. Economists agree that it will

never go away. There is an obvious reason. the better technology gets,

the less work

there is to do. You cannot expect people to work for every bit of money

they get when there is not enough work to do.

The

rich can be

as lazy as they like as long as someone is looking after their money.

Most of the rich got most of their money without working. They

either inherited it or manipulated the system to ensure the big money

flowed their way. Usually both. If we had to work for every bit of

money we got, inheritance would be illegal! At the very least there

would be high inheritance taxes, say 50%. Beyond, that, billionaires

never "earn" more than a tiny fraction of

their money. To earn a billion dollars at 10 dollars per hour (24 hours

a day, 7 days a week) would take 100 million hours, that's over 10,000

years.

Clearly,

not everyone

has to

work. So why do we stubbornly believe that everyone has to work? Ideas

that we take for granted are often

socially constructed by powerful people to serve their interests. This

particular

idea is promoted by the rich to ensure that the

poor will keep working for them. The idea is also promoted by the

middle classes, whose position in the pecking order depends on their

support for the rich.

What is

true is first that everyone

needs enough money to live on, to ensure

quality of life and second that everyone

needs to be motivated to work, to ensure that

the important work is done.

- Myth no. 4:

It's a bad idea to give BI to the rich. The truth: It's

a

bad idea not

to give BI to the rich.

BI+CI would reduce the net

income of the rich. They would lose

more in additional income tax than they would gain in BI.

Besides,

if

the BI was

means tested, someone would have to apply that test and check

people were providing the correct information. Many would try to trick

the system. How many bureaucrats would be

needed to administer that?

- Myth no. 5:

BI+CI is bad because it is inflexible. The truth: BI+CI's

inflexibility guarantees that everyone will be

treated equally.

Policians

like to claim that they are using public money

efficiently by

making sure those who need it get it, and those who do not do not. From

that perspective, BI+CI is a bad idea. It is too inflexible! In other

words, politicians can no longer manipulate welfare and taxation to

attract voters in specific

categories and win elections.

In fact, when it comes to ensuring people’s livelihoods,

inflexibility is a virtue. The risk of arbitrary exceptions,

discrimination, favoritism and so on is avoided. What is

flexible is the numerical value

of BI and CI, both of which can be adjusted in

democratic

political processes. After that, both values apply to all people

equally.

The universal declaration of human rights is similarly inflexible.

Everyone has the same rights and obligations, period.

Left-wing

economic theory

A 2019

article in The Guardian

entitled "The new left

economics",

Andy Beckett observed that

For

almost half a

century, something vital has been missing from leftwing politics in

western countries. Since the 70s, the left has changed how many people

think about prejudice, personal identity and freedom. It has exposed

capitalism’s cruelties. It has sometimes won elections, and

sometimes governed effectively afterwards. But it has not been able to

change fundamentally how wealth and work function in society

– or

even provide a compelling vision of how that might be done. The left,

in short, has not had an economic policy.

BI+CI is a response to that challenge. The world needs new

left-wing economic theory and policy that can eliminate poverty and

reduce the wealth gap in the 21st century.

Left-wing economic theory is a diverse thing, and it even includes

objections to BI. Many on the left have been suspicious about

BI ever since Milton Friedman, a conservative US economist, proposed

negative income tax, which is almost the same thing. Milton Friedman

also inspired the unmitigated disaster of neoliberalism. It was part of

his theory of freedom.

But something is not bad just because a bad person proposed it.

Vegetarianism is not bad because Hitler was a vegetarian. The concept

of BI+CI that I am proposing is a general foundation that both the

right

and the left can use for their own purposes. The right can reduce BI

way below the poverty line while at the same time increasing CI. Of

course, I totally oppose that idea, but it is theoretically possible.

The left can elevate BI well above the poverty

line, while reducing CI (increasing income tax) to finance it. I also

oppose that, because it

would stifle incentive to work. The point is to democratically find a

middle

path that allows everyone to enjoy the benefits of both appropriately

tamed capitalism (the source of wealth and abundance) and appropriately

democratic socialism (the source of community and solidarity). The aim

of this document is to describe how that middle path can be achieved in

practice.

The

main aim of right-wing politics is to maintain or increase the

wealth of the rich, which usually means maintaining or exacerbating

poverty. One important right-wing strategy is to lie about economics.

It also

helps

to own the media. That being the case,

the political left

generally benefits from simplification of

tax-welfare systems:

- Only

the right can afford

expensive accountants to play games with the system. The simpler the

system, the fewer games can be played. An important advantage

of

BI+CI

is its lack of loopholes, especially if tax deductions (which

traditionally benefit the rich more than the poor) are no longer

allowed.

- An

important general strategy of the political

right is

deception. In fact, without deception, the right can hardly win

elections (more).

A complicated

tax-welfare system gives the right wing many opportunities to trick

low-income earners into voting for them, against their interests. A

good way to

stop the lies, or help people to see through them, is to radically

simplify the system. A simple system is more transparent, and hence

more democratic.

This,

then,

is the left-wing economic theory that I am proposing:

radical simplification of both tax and social security so that poverty

can be eliminated and everyone is motivated to work (but free not to),

and the right can no longer trick and deceive the

left. Democracy based on human rights and honesty.

BI+CI would also change how we

think about money.

In modern

capitalist democracies, people "earn" money, the amount depending on

work and ability. Exceptionally, people receive benefits if they are

somehow desperate, for example if they are unemployed despite

reasonable attempts to find work. These are conservative, capitalist

ideas, and BI+CI would replace them with more progressive, centrist

ones. The

reasons and

justifications for earning or receiving money would change as

unemployment benefit and income tax were combined into a single

package. You would

no longer have to "earn" money or need to be "desperate" to

receive it. Instead, everyone would be entitled to both fulfilment of

basic needs (BI) and reward

for work (CI). Public economics would align better with

principles of human rights.

The

art of political

compromise

Imagine

a peaceful society with

a high

standard of living and a sustainable economy. It can be achieved by

striving for a balance between two principles: the right-wing principle

of motivation

to work and the

left-wing principle of fairness.

- Motivation:

CI means everyone is

equally motivated to

work.

- Fairness:

Universal, unconditional BI means

everyone is valued and

treated equally.

We

don't have to choose between those two alternatives. We can have both.

BI+CI shows how it would work.

For

individuals, financial

success in one's chosen career usually depends on two things: privilege

and work

or talent. You

usually need both to succeed financially, but

there are exceptions. Everyone knows stories of rags to riches (e.g.,

Bob Marley had no privilege, but certainly had talent, and he also

worked hard). There are also stories of rich people who live off their

inheritance and otherwise do very little (see any celebrity gossip

magazine). And there are are the fallen billionaires, and lotto winners

who squander everything. These extreme examples are especially

interesting, so we remember them more easily that other everyday

examples. But they are exceptional. In fact, most people need both

privilege and work/talent to succeed. BI+CI makes it possible for

everyone to succeed financially by giving everyone a certain

privilege (BI, corresponding to left-wing ideology), and rewarding

everyone to the same extent for their work/talent (flat income tax, a

right-wing

idea).

In that way, BI+CI can be truly democratic and bipartisan.

Capitalism has achieved a

lot, but it never managed to eliminate

poverty. In

a capitalist economy, a

rich

elite

is in charge (democracy is not working), most people are struggling to

get by (poverty is intrinsic), and the system is gradually destroying

itself (biodiversity loss, climate change, nuclear threat). The

communists

similarly tried valiantly and idealistically to eliminate

poverty, but failed. That

is because someone has to be

in

charge, and power inevitably

corrupts. Communism sounds great in theory, but in practice

it tends to make everyone poor except

for a small elite. It also has a remarkable tendency toward

self-destruction. The failure of communism does not make capitalism any

better. Humanity

has

tried repeatedly to make either communism or capitalism work,