|

Free

enterprise without poverty

Effectively

Progressive

Income Tax

UBI-FIT = Universal Basic Income + Flat Income Tax: a rational, centrist

blend of

efficiency,

transparency, fairness and freedom

© Richard

Parncutt 2006-2016;

talk on 16.6.09 ppt

|

|

Before reading this, read

this

Further information

Summary

UBI-FIT

aims to

significantly reduce

the gap between rich and poor within industrialized countries, and to

effectively eliminate poverty. UBI-FIT

stands for

Universal Basic Income and Flat Income Tax.

"Universal" (or

unconditional) means applying to all

taxpayers and all welfare recipients in the country in question -

including children and pensioners. Under UBI-FIT, everyone

would be treated equally with

one exception: people with disabilities would get a special deal (as

they do now).

At

first glance, this seems impossible. Two questions arise immediately.

(1) Why give money (basic income) to people who don't need it (the

rich)? (2) Progressive

income tax scales aim to reduce poverty, so how can

poverty be reduced by getting rid of

them?

Let's briefly consider each question.

(1)

For low income earners and the unemployed, unconditional basic income

would replace current benefits. The money would be much the same, but

the labels would be different. For high income earners, unconditional

basic income would be much smaller than the tax that they pay, or

should pay. They would pay more tax, because tax evasion and avoidance

would be reduced through a general simplification of the system and

increase in transparency, as I will explain in detail below. That would

compensate several times over for the basic income that they also

receive.

(2)

Progressive tax scales may seem to benefit low-income earners, but the

gradually increasing gap between rich and poor in most countries

suggests that something is seriously wrong. In fact, the total

amount that

low earners gain (and high earners lose) from progressive tax

scales and social benefits is smaller than the total

amount gained by the rich through avoiding and evading tax. And in the

end, it's the total that counts! Seen another way: The government gives

low earners large numbers of small payments, but at the same time high

income earners avoid paying small numbers of (very) large payments. The

large number of small benefits for low earners gives them the

impression that the system is fair, but in fact they are being tricked.

A good example is value-added tax (consumption tax): low-income earners

pay a higher proportion of their income in VAT, which in typical

Western democracies approximately balances out the supposed advantages

of progressive income tax. For this reason, VAT should gradually be

phased out except for luxury goods, but that is another story.

So

before we can consider reducing the rich-poor gap by giving low-income

earners real benefits through the taxation and welfare systems, we have

to create a level playing field in

which everyone is treated equally. It is also important that people

understand how the system works, so that they can vote for those

political parties that truly support their interests. In short, we need

more fairness

and more transparency.

Both of these points are goals of UBI-FIT, and of this document.

Another

important point: UBI-FIT incorporates a

flat income tax, but effectively,

taxation would be progressive - to about the same degree as at present.

The effectivetax

rate is the difference between gross and net income expressed as a

percentage of gross income. Under UBI-FIT, this ratio would increase

with

increasing income, as it does in current progressive tax

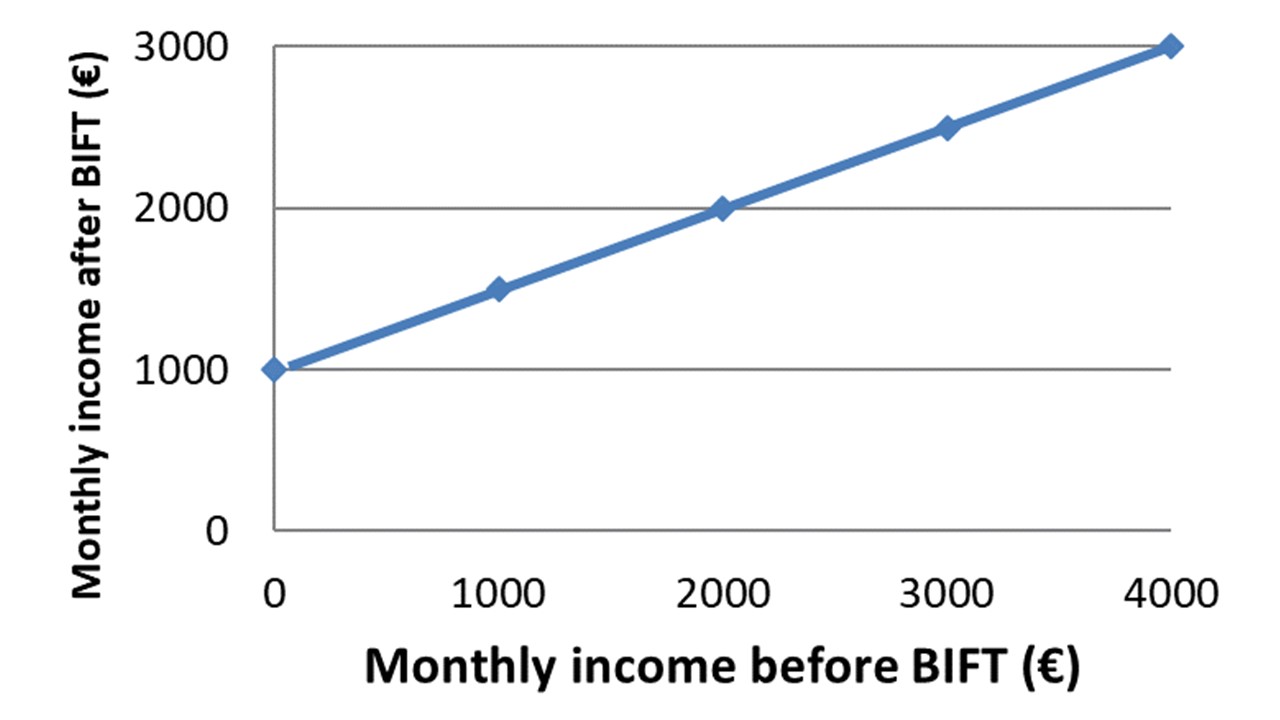

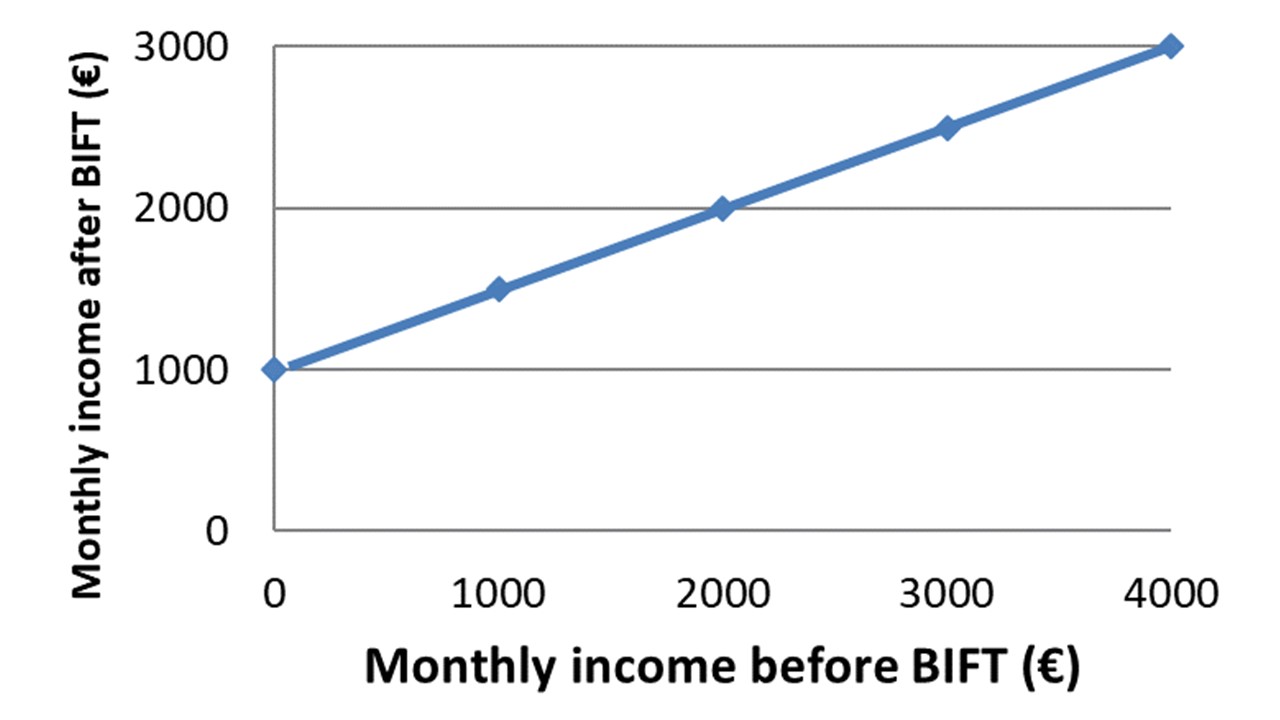

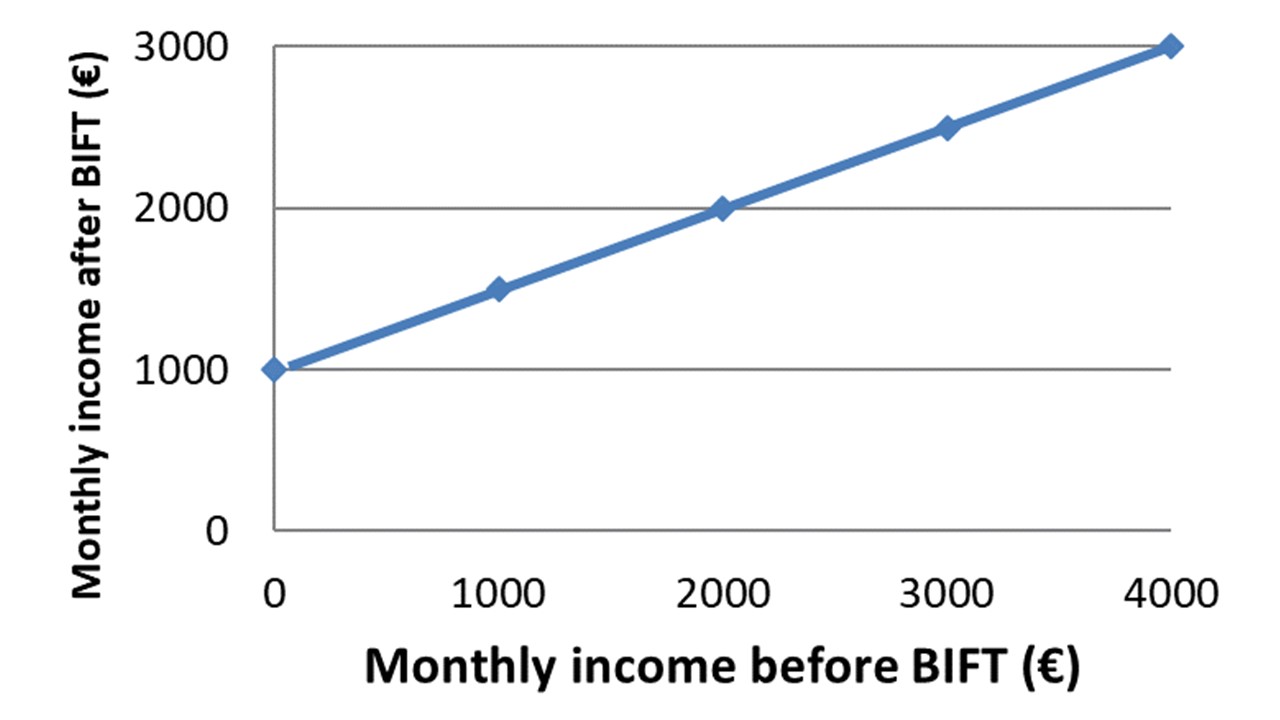

scales (see the graph below). If the acronom "UBI-FIT" is misleading,

it can be replaced by "effectively progressive income tax".

When

expressed in terms

of the relationship between gross and net income, UBI-FIT is

similar to the current system in modern industrial

democracies. Initial values of basic income and flat tax would be

determined by drawing a line of best fit through the current

relationship between gross and net income (see graph below). Some

individuals would initially have more money, others less, but the

differences would be small and could be smoothed out during a

transition period.

UBI-FIT would

be

superior to

the current system in several important ways.

- UBI-FIT would

eliminate welfare

traps and the stigma attached to receiving

benefits. Currently, people on welfare may be reluctant to

take

paid employment because it would mean reducing or giving up the

benefit. That is bad for them personally because it prevents them from

improving their situation. But it is also bad for the country because

it reduces productivity. A solution to this problem is urgently needed.

Under UBI-FIT all people, rich and poor, would get the same "benefit"

(basic income, applied as a tax deduction to higher incomes). The

difference between welfare beneficiaries and others would disappear,

along with the stigma. UBI-FIT would spread work

incentives

evenly across all income brackets. Everyone would be

motivated by

the reward of higher income to work harder, more efficiently or more

creatively. The incentive would be the same regardless of current

income.

- UBI-FIT would

considerably reduce

private and government expenditure by

enabling a radical simplification of both income tax and welfare. Since

the tax rate would be constant, it could be paid directly every time

money was earned. Yearly income statements for individuals, which

currently cost significant amounts of time and money for both

individuals and government, would become a thing of the past. Expenses

incurred to produce income would be compensated for individually in

cash. Successful applications (filled form plus receipt) would

be

rewarded with cash rebates equivalent to the current flat tax

rate

multiplied by the expense in question. That would further increase tax

revenue by reducing the number of bogus tax deductions.

- Simplification

of the system would mean that more voters understand it. So the results

of elections would correspond more closely to public interest.

Election results would indirectly determine the system's two free

parameters: the basic income rate and the flat tax rate. That in turn

would determine the size of the deficit and the poverty rate. In the

long term, both can and should be eliminated.

- UBI-FIT would

reduce tax evasion at

both the low and the high ends of the

income spectrum. At the low end, people who work for cash and

pay

no tax (the "black market") would be offered a choice between two legal

options: either (i) receive the basic income and commit

yourself

to the flat tax (employers would be responsible for informing the

tax/welfare office of employee status) or (ii) do without the basic

income, provided your income does not exceed it. Since people would be

better off with (i), they would generally choose that option and become

part of the system.

At the other end of the spectrum, high income

earners would find it more difficult to avoid or evade tax,

because the system would be simpler and more transparent with

fewer loopholes. All income tax would be paid immediately,

when

money is earned. Capital gains and wealth tax are not part of UBI-FIT,

but UBI-FIT suggests that both should be flat taxes whose rates could

be

increased beyond current levels without affecting productivity. That

would further reduce the gap between rich and poor. But new

international agreements would be necessary to avoid

exodus of capital.

Communists

have traditionally assumed that poverty is inherent to capitalism, and

communism is the only way to eliminate it. In fact, communist countries

never eliminated poverty, because almost all citizens of communist

countries were poor by comparison to the middle classes of capitalist

countries. UBI-FIT would allow this problem to be solved for

the

first time in history. The power of free enterprise can and should be

harnessed to eliminate poverty; and

if it succeeds, there is nothing morally wrong with it.

UBI-FIT would involve a radical change of thinking. It would be

especially

challenging for politicians to convince their voters of the advantages

of UBI-FIT. But first the economists need to investigate and support

the

idea. As long as most economists are uninterested in poverty reduction,

and those that do are locked into superceded socialist

steretypes, UBI-FIT will be not be a realistic political option.

Frequently asked questions

Question

from a fictive left-wing

reader: Are you crazy? Flat

tax has always been associated with

the worst kind of laissez-faire capitalism. You sound like one of those

awful neoliberal entrepreneurs. Everything seems fair on

the surface, but underneath you presumably want to make money for

yourself, or help other people who already have plenty of money to make

more.

Answer:

Quite the opposite. I

am writing this because I want to make a positive contribution to

society: I am naive enough to believe that is possible. If I am lucky I

will add another publication to my publication list. I don't see a

possibility of making money unless I somehow find time to write a

best-selling book on the topic. I

want to eliminate poverty for the first time in history (yes, I really

mean eliminate,

not just put

another bandaid on it). What others often forget is that that involves

generating the necessary finance. The plan is to apply a flat income

tax at about the rate

that the rich now are supposed to pay in the highest tax brackets, e.g.

40% or 45%. This rate will be applied to everybody. That is good news

for low income earners, because welfare traps will be eliminated that

at the moment can

effectively mean a tax rate of 100% or even more. If you are getting a

benefit and lose it when you earn more money, you are working harder

but getting no more for your trouble, which is equivalent to paying

100% tax. And incidentally the main problem with the rich is not that

they don't pay enough tax, it is that they often effectively pay none

at all. Only the rich can afford to pay crafty accountants to develop

schemes and strategies to evade and avoid tax. One approach to solving

this problem is to simplify the system so that there are fewer

loopholes. Flat income tax means it is impossible to avoid income tax

by shifting it to other people, bank accounts or time spans. It is not

the ultimate solution, but it would help.

Question

from a fictive right-wing

reader: Are you crazy? If

you give everyone an unconditional

basic income, they will not be motivated to work. Incentive will be

reduced, the effective number

of unemployed will increase, and productivity will fall.

Answer:

It's not quite that

simple. People are primarily motivated to work by the additional money

that they earn when they work. Under UBI-FIT, the increase of net

income

for a given increase in gross income would be the same for everyone.

From that viewpoint, under UBI-FIT everyone would be equally motivated

to

work. You

are right that incentive will fall if unconditional basic income is too

high. For the purpose of calculation I have proposed an

initial

level of about 1000 Euros. That is slightly above most estimates of the

European poverty line. Perhaps the initial should be lower. In any case

the amount would have to be adjusted in a political process.

Another

question from that fictive

left-wing reader: Are you

crazy? You cannot expect someone to

live on 1000 Euros per month. Could you do that?

Answer:

You are right, I

personally would find that difficult, even if I got extra basic income

for my

children. But for people living in poverty this would be a great relief

- comparable with what they can get now from social security, but

without the stigma of being "unemployed" and without the constant

bureaucratic interference and pressure to find a job.

Yet

another question from that

fictive right-wing reader:

Are you crazy? What about the black

market? What about all those people working for cash?

Answer:

Those people should

be

offered two legal alternatives. Either register for basic income and

pay tax,

or don't register and continue not to pay tax. The first option would

generally be more attractive for low-income earners because it would

give them a higher overall income. As for legal enforcement, employers

should

be required to check their employees' documents, and if employees are

registered for unconditional basic income employers should be required

to ensure that

it their income tax is paid. It should be illegal for employers to

pay cash in exchange for work; the money must instead be transferred to

a bank account. Both employee and employer should be responsible for

ensuring the income tax is paid, which would bring about a gradual

change in work culture.

This would push up wages for jobs like cleaning, gardening and

babysitting, but that can be seen as an advantage: rates of pay would

more closely reflect the market value of the work being done.

Moreover, another kind of poverty trap would be eliminated, namely the

trap that keeps people in cash employment, avoiding the transition to

official paid employment. This boundary would disappear, which would

encourage socio-economic mobility.

Summary in German. Armut

auslöschen mit bedingungslosem

Grundeinkommen, Flat Tax und

Vermögenssteuer. Die immer wiederkehrende Diskussion

darüber, wer wie viel vom Kuchen erhalten soll,

könnte

entbehrlich sein. Stellen Sie sich vor: alle BürgerInnen vom

Baby

zum Greis erhalten ein bedingungsloses Grundeinkommen von ca.

€1000

- egal ob arm oder reich. Nur

Menschen mit Behinderung erhalten mehr Grundeinkommen. Stellen Sie

sich weiters vor, dass der

Einkommensteuertarif für alle gleich ist, ca. 40%. D.h.: keine

Zuverdienstgrenze und keine Sozialstaat-Falle. Keine staatliche

Einmischung und keine Stigmatisierung von Arbeitslosigkeit. Keine

Moralkeule, kein Neid, kein Grund zum Jammern. Gleicher

Leistungsanreiz für alle sozialen Schichten. Auch gleiche

Vermögensteuer für alle -

auch ein "flat tax", damit diese Steuer nicht durch Umschichtungen

vermieden oder reduziert werden kann. Um Kapitalflucht zu vermeiden

werden

internationale Vereinbarungen angestrebt und Steueroasen geschlossen

(eine wichtige und dringende Aufgabe von EU und G8). Alle genannten

Zahlen werden laufend demokratisch eingestellt, bis

Armut

und Staatschulden verschwinden.

Erst dann könnte man

von einer "guten" Konjunktur sprechen.

Introduction:

The basic idea

Poverty

is a serious problem. Even in the socially secure and apparently

generous European

Union, the rate of poverty varies across countries between 10%

and 23%, depending on how

poverty is

defined. Given the general wealth of the EU, this is an embarrassing

problem that must be solved. The study Vermögensbildung

und Reichtum in Österreich

found that 1% of

Austrians own 34%

of Austria's wealth. The situation is worse in the USA: to get

a

feel for how ridiculously rich the rich are in the USA, visit the L-curve page.

Moreover, in most countries today, the gap between rich and poor is

increasing. If nothing is done the situation will get even

worse.

According

to the Global

Wealth Report 2010, Austria, a

country of 8 million

inhabitants,

has 37 thousand (!) millionaires and 300 households with more than 100

million US dollars. (Please read that sentence again, there are no

misprints!) The total private wealth of Austria is 656 billion US

dollars. Worldwide there were 12.5 million millionaires in 2010, which

was 12.2% more than in 2009. Given these figures, anyone who says we

cannot afford a universal basic income is speaking pure nonsense, aka

bullshit. Unfortunately, we often encounter nonsense in our daily

lives, for example in advertisements (just turn on the TV), at the

pharmacy (homeopathic medicines) and the church (Jesus was the son of a

virgin, brought Lazarus back to life and rose himself from the dead).

If we learn to recognize and reject all forms of nonsense, we might

have a chance to get rid of poverty, which is a much more serious

problem than misleading advertisements, placebo mediction, and perhaps

even religious fantasy.

Many

people believe that an unconditional

basic income at

a level corresponding to the poverty line (in

Europe: 800-1000 Euros per month) can eliminate poverty. But what about

motivating individuals

to work? And what about balancing the budget? Regarding motivation,

the more

you give to people who are unemployed,

the more they lose when they get a job - which reduces the motivation

to look for a job and accept job offers. It is no use blaming people

and accusing them of being lazy - the problem is in the system, not in

the people. Regarding the budget, basic income must be affordable. If

it leads to a net increase in social security payments, the money has

to come from somewhere. This are serious problems and they cannot

simply be swept under the carpet. If we really want to eliminate

poverty, we have to take these problems seriously.

We

also need to think about the complexity of the system and and the

implications of that complexity for democracy. Politicians

regularly use "tax reforms" and "welfare reforms" to attract votes

from particular target

groups. The broader implications of such "reforms" for society and

the economy may get lip service, but are essentially ignored if

politicians are

assuming that voters

are selfish and care only

about their

income. Over the

decades, these

special offers and exceptions mount up. The system gets too

complicated. Ordinary people tend to know only about rules that apply

to them. The do not and cannot understand the entire system.

Armies of

accountants and bureacrats are need to administer it - and often spend

their lives doing so. That is not only very inefficient - it is also

undemocratic. When politicians talk about changing the system, people

are not in a position to evaluate the changes. They don't know

what they are voting for.

What

have previous "tax reforms"

achieved? We still have poverty, welfare traps, black markets, and

time-consuming income declaration procedures that only experts properly

understand. The taxation and welfare systems are regarded as

fundamentally unfair by the rich, the poor, and those in between.

Considerable government revenue is lost every

year through welfare

fraud

- but much more is lost through the management of the complex

tax-welfare system (just think of what all those bureacrats and

accountants are earning, when you add it all up). And by far the most

government revenue is

lost through tax

avoidance/evasion,

facilitated by the system's complexity and its innumerable loopholes,

of which new ones regularly emerge and are discovered by smart tax

consultants.

The aim of this document is

to

present a radically new and simple idea that would largely solve most

of these problems. The basic ideas are as follows:

- Poverty

can and should be eliminated. Modern Western democracies have been rich

enough to achieve this goal for decades. Moreover,the gap between rich

and poor is far too large. It can and should be sustainably reduced.

- Everyone

should be motivated to work to the same extent. Any significant

increase in working hours should translate into a significant increase

in income. That is not the case at the moment (due to "welfare traps").

- Everyone

can and should be treated equally. It is unnecessary to create a

special class of "welfare recipients" who get more handouts, or a

special class of "rich" who pay extra tax. This is not a political

statement - it is neither left-wing or right-wing. It is a pragmatic

observation based on simple mathematics, as I will explain below.

Dear

reader: If you have read this far and don't think it is possible to

simultaneously achieve the above three goals, the reason may simply be

that you haven't read the rest of this page. Please adopt an open

attitude, be prepared for surprises, and read on:

Under UBI-FIT,

everyone

would

receive a basic

income (that is, basic income would be absolutely unconditional), and everyone

would pay the same

rate of tax on all

other income.

Both the level of basic income and the rate of income tax would be

independent of income. The

political debate about welfare and tax would be largely confined to one

dimension, corresponding to the tradition left versus right distinction:

- whether,

how and to

what

extent the gap between rich and poor should be reduced (left), and

- whether,

how and to

what

extent the

incentive to work should be increased (right).

Who

will win? The

simplicity of the

new system would mean that both these goals could be achieved

simultaneously. The gap between rich and poor would be reduced because

voters, who for the first time would understand the main global

features of the tax/welfare system, would vote for levels of basic

income and income tax that are appropriate for achieving that goal. The

incentive to work would be increased both people who are currently

unemployed and/or receiving social benefits (they would no longer have

to deal with welfare traps - more about that below), and for those

(few?) high income earners who currently pay their income tax fairly.

Who

will lose? Some people

will end up

with less money at the end of the day

under UBI-FIT. I am

talking about those high earners who take advantage of the

complexity of the system to reduce their income tax bill. They have

crafty accounts who know all kinds of legal tricks. These are also the

people who will oppose UBI-FIT most strongly. They will be

very

creative in their attempts to distort the truth as they try to convince

voters to maintain the current complex system. People are so confused

already they are likely to believe them. That is a difficult problem to

solve.

Unfounded

fears. Left-wing

sceptics object that the gap between rich and poor would be increased

by the flat tax, and right-wing sceptics fear that the economy would suffer

from the universal provision of basic income. Both

these predictions are incorrect. When typical levels of welfare and tax

are chosen, exactly the opposite would happen. The

rich-poor gap would be reduced by the basic income, and the flat tax

would boost the economy. These predictions follow from the simple

mathematics upon which UBI-FIT is based.

A fresh approach. In

the author's experience, most

opponents of UBI-FIT do not understand this simple mathematics, as

illustrated by the table and the graph below. The current system is so

deeply ingrained in our thinking that it is hard to let go of it. In

order to understand UBI-FIT you have to clear your mind and start

afresh.

Another problem is that "basic income" is associated with left-wing

politics and "flat tax" with right-wing politics. In UBI-FIT,

this is

no longer the case: both concepts belong to the political

centre.

My bias. To

avoid possible misunderstandings, let me be open about my

own

political bias, which could be described as centre-left liberal green.

For me, the basic income aspect is more important than the flat tax

aspect. I can imagine and

accept a system in which unconditional basic income is

combined

with progressive tax scales, as proposed for example by the Basic Income Earth

Network.

This text is not intended to conflict with such approaches, but to

complement and extend them. I am completely opposed to

any form of flat income tax that is not coupled to an

unconditional basic income, because any such system would presumably

increase the gap between rich and poor. And that gap is already

considerably larger than necessary to motivate people to work and

improve their financial position.

UBI-FIT is mainly

about

eliminating

poverty. In

the Western world today, no-one questions

the importance of democracy in the form of "one person, one

vote". And not many would question that everyone should be treated

equally and all kinds of discrimination should be gradually exposed and

eliminated. Moreover, most agree that every person has the right to

freedom from poverty. The Universal

Declaration of Human Rights

(1948), Article 25, provides that "Everyone

has the right to a standard of living adequate for the health and

well-being of himself and of his family, including food, clothing,

housing and medical care and necessary social services, and the right

to security in the event of unemployment, sickness, disability,

widowhood, old age or other lack of livelihood in circumstances beyond

his control."

But since there is still so much poverty, even in rich countries, not

many support the idea that

everyone has the duty to contribute fairly to national

budgets through taxes. The problem can be solved by giving

everybody an unconditional basic income at a level that enables

survival AND obliging everyone to pay tax in a fair way on all

additional income and all wealth. By "survive" I mean no risk to life

and no significant risk

to health due to chronic lack of food, shelter, clothes, heating,

medicine and so on. This is not a bad goal when one considers the

relationship between life expectancy and income even in rich

countries (link).

In

industrialised countries, we are

close to achieving

this goal, and at

the same time maintaining and even promoting capitalist financial

incentives. We can also eliminate welfare traps so that everyone has a

good chance of raising their standard of living well above the poverty

line. In that way, poverty can be sustainably

eliminated. Just imagine a future version of the universal declaration

of human rights that states that (i) everyone has the right to a basic

income, (ii) everyone has the duty to pay tax on all earnings and all

wealth, and (iii) in all these respects everyone has the right to be

treated equally. That is essentially what UBI-FIT is about.

UBI-FIT embraces

both socialist and capitalist principles. The

goal of

eliminating poverty is a classic socialist goal. On the capitalist

side, UBI-FIT would motivate all members of society to work (harder or

better) to the same extent. No-one would be demotivated by the

possibility of moving to a higher tax bracket or being taxed more than

someone else. More importantly, no-one would be demotivated by the

possibility of losing a welfare benefit as a result of earning too

much. Seen in this way, UBI-FIT represents and implements a new

positive,

constructive

attitude to the relationship between socialism and capitalism. These

two ideologies are no longer seen as contradictory. Instead, they are

eminently compatible. They

are like love

and marriage, which the

old-fashioned romantics among us assume to

be inseparable:

Love

and marriage (...)

Go together like a horse and carriage (...)

You can't have one without the other

This

text is intended as a quick introduction to UBI-FIT - just

enough to whet

your appetite. It is written in a clear, concise, popular style.

You don't need a university degree in public economics to understand it

(most other literature about "basic income

and flat tax" is addressed to an academic audience). The arguments

apply primarily to modern industrial democracies; the question of

UBI-FIT

in developing countries is beyond my scope.

Examples

of gross and net

monthly income

under UBI-FIT

To

understand UBI-FIT, it is important to distinguish between real

and effective

rates of taxation. The real

rate is the way in which the tax is levied (e.g. "give me x% of amount

y"). The

effective rate takes into account gross income, which in UBI-FIT

includes

basic income.

The

difference between real and effective tax rates is

important when considering progressive

taxation. In most countries today, the income tax rate

increases incrementally

as gross income increases - it is different in different income tax

brackets. The

table below shows

that, with UBI-FIT, the effective

tax rate would

also be progressive, even though the real

rate is

constant. Moreover, the effective rate would increase

continuously with

income.

Suppose

for the purpose of

argument that the basic income is 1000 Euro/month and the flax

tax is 50%. The effective tax rate

is defined as the difference between

gross and net income, expressed as a percentage of gross

income. Gross

income is income before both basic income and flat tax; net

income

is income after both basic income and taxation. Here are some simple

examples of the relationship between gross and net income, and the

corresponding effective tax rate:

|

gross

monthly income (€/mo)

|

net

monthly income (€/mo)

|

effective

tax rate

|

|

0

|

1000

|

negative

infinity

|

|

2 000

|

2 000

|

0%

|

|

3 000

|

2 500

|

17%

|

|

4 000

|

3 000

|

25%

|

|

5 000

|

3 500

|

30%

|

|

10 000

|

6 000

|

40%

|

|

100 000

|

51 000

|

49%

|

Break-even

point. Under UBI-FIT, income

tax would effectively

be claimed only from

people whose income exceeds a certain amount - as in the present

system. For example, if your gross income is 2000 Euros per month, your

net income under UBI-FIT with a basic income of 1000 Euros/month and

tax

rate of 50% (remember that these values are arbitrary) will be the

same: you will pay 50% of 2000 Euros in tax and

receive the same amount back as basic income. This is called the break-even

point. Effectively, you

will pay no tax and receive no

benefit. At higher incomes, the effective rate of taxation gradually

increases, and for very high incomes, the effective tax rate approaches

the flat rate (here, 50%); incidentally, the highest income brackets

have been taxed at a rate exceeding 50% in some countries, e.g. Sweden.

If your gross income is less than the break-event point, your net

income will exceed your gross income - but regardless of what happens,

you income will never fall below the basic income. If

basic income is set near the poverty line, UBI-FIT

effectively eliminates poverty.

Adjusting

the basic income and flat tax rates

What

is the right or optimal rate of basic

income and flat tax? The values of 1000 Euros/month basic income and

50%

tax rate in the table are arbitrary round figures - chosen to

simplify the calculation. In a real application of UBI-FIT, they would

be

adjusted to satisfy the wishes of the electorate and government

policy (right or left wing) as well as basic economic constraints

(balancing the budget, managing the national deficit, and the

predictions of economic models). An unconditional basic income of 1000

Euros could be supplemented by various conditional benefits, but the

system of supplements could be much simpler than the present welfare

system. A lower flat rate of tax (perhaps as low as

35%) may be possible depending on government income

(including other forms of tax, for example wealth tax) and

other expenses.

The

main constraint on the exact level of

basic income and tax rate is to balance the budget. Any increase in

basic income will reduce the incentive to work (if you have enough

money, why work?). Similarly, any increase in the tax rate will reduce

the incentive to work (why work harder if I get less money for it?). So

any increase in basic income or tax rate can reduce productivity, which

reduces tax

revenue. That in turn may necessitate a reduction in basic income,

since there will be less money available to finance it (unless it

partially financed

from other sources such as wealth taxes). Arguments of this kind reduce

the range within which basic income can vary.

How

progressive is UBI-FIT? Although it is based on a flat income tax, the

above table show that UBI-FIT is no less progressive than the system

currently in place in most industrial democracies. The difference is

that it is consistently

progressive - it is not affected by welfare traps (currently, you lose

your handout, either suddenly or gradually, if you earn too much). The

progressivity of UBI-FIT can be adjusted by changing the

basic income and tax rate. If basic income is increased, the tax rate

must be increased to finance it, and the effective tax rate becomes

more progressive. If both basic income and the tax rate are reduced,

the effective tax rate becomes less progressive. In this way, UBI-FIT

eliminates the need for different income tax brackets. The tax-welfare system

becomes

simpler, directer and more transparent, and the rich can no longer

avoid tax by shifting income to different (virtual) income earners or

different financial years.

Another

way to make the system more progressive is to increase taxes on wealth

and increases in wealth (capital gains), or conversely on sources of

income such as speculation and inheritence. I am personally in favor of

higher taxes for the wealthy, but the question is beyond the present

scope. UBI-FIT would be essentially the same as the present system at

high

income levels

Benefits of UBI-FIT

Most

socio-economic groups would benefit from UBI-FIT:

- The

unemployed would be

freed from

stigmatisation, bureacratic harassment, welfare traps and the threat of

poverty. There would be no

limit to additional earnings beyond

the basic income, so welfare

traps would be eliminated and economic

mobility facilitated.

- If

the values of basic income and tax rate were chosen appropriately, the

net income of the middle classes would change little; the

main

benefit for them would be that they waste less time preparing tax

returns - and money paying tax consultants.

- The

rich would experience UBI-FIT both positively and negatively. On the

positive side, they would no longer feel that they are

financing

the welfare system, since they, too, would receive basic income - as a

tax deduction or "negative tax". Nor would they feel that they are

being penalized by progressive tax scales. They would presumably like

the idea of everyone paying

the same rate of income tax and in that sense being equally motivated

to work - a kind of capitalist ideology. But under UBI-FIT the

rich would find it harder to evade

or avoid

income tax,

because the system would have fewer loopholes and income tax would be

calculated and paid immediately rather than at the end of the financial

year. It would no longer be possible to avoid the highest income tax

bracket by shifting income from one financial year to another, and

other tricks such as distributing income among different people would

be harder to pull off. A significant reduction in evaded and avoided

tax would mean a considerable increase in government revenue available

for

redistribution - even if the official tax

rate for high incomes remained the same.

Short-term disadvantages of UBI-FIT

At

first glance, UBI-FIT sounds just too easy - too good to be true. If

UBI-FIT

is so easy and so good, why didn't we convert to UBI-FIT long ago? I

guess

there are two main answers to that question.

- First,

UBI-FIT is hard to

understand for those entrenched in the current way of thinking. We are

talking about a radical change in economic culture. Those

who oppose UBI-FIT have often not understood the underlying mathematics

-

in spite of (or perhaps because of) its simplicity. They cannot believe

that

the solution to so many problems could be so simple. They are not

prepared to fundamentally question and revise prevalent preconceptions

about basic income (which the right wing thinks encourages laziness)

and flat tax (which the left wing associates with the worst excesses of

laissez-faire capitalism). They do not realise that, ultimately, the

most important thing is the

mathematical

relationship between gross and net income. The specific levels of

welfare and tax, and the way these are calculated, are means to an end

- not ends in themselves.

- Second,

UBI-FIT would

prevent a lot of tax evasion or avoidance. Those who benefit from that

tend to be both socially and politically influential, not to mention

(selfishly) creative and (discretely) dishonest. They are in a good

position to invent misleading

arguments against UBI-FIT and other trends toward (simplification and

transparency of taxation) that sound convincing to the general public.

The

transition to UBI-FIT would create the following short-term problems,

but

the long-term benefits would outweigh the short-term costs.

- Since

all income including low-level wages for part-time work would be taxed,

gross wages at this level would rise and net wages would fall, reducing

the difference between low and high wages. Wages would more

realistically represent the real value of work on the free market,

because the system would treat all wage earners equally. Part-time work

would become more expensive for employers, because they would

indirectly be paying more tax (the tax that their part-time employees

pay); that would need to be compensated for in other areas to maintain

business incentives.

- Taxation

offices would need new personnel to check that all income is being

taxed, from part-time jobs ("cash economy") at the low end to profits

of all kinds (e.g. through investment and speculation) at the high end.

At the same time, taxation offices would need fewer staff to check

annual tax statements, since many people would pay all tax at the time

of transaction and not qualify for a return at the end of the financial

year. Much of the processing of on-the-spot income tax would be

performed automatically by computer. If these two changes involved

about the same amount of work, the number of employees in taxation

offices would remain about the same, but some retraining would be

necessary.

Central issues and misconceptions about UBI-FIT

The

idea of UBI-FIT can only catch on if people understand it. That

is not easy, because UBI-FIT turns the familiar system of progressive

tax

scales and diverse, mean-tested social benefits on its head. It's one

thing to understand the basic idea and another to revolutionize one's

thinking about tax and welfare. That is the challenge of UBI-FIT.

- The

political left think that UBI-FIT is a right-wing concept, because it

includes a flat tax (even if tax is effectively

progressive). The

political right think that UBI-FIT is left-wing, because it includes

basic

income (even if everyone receives that income, including the rich). In

fact, UBI-FIT is neither left nor right, but politically neutral.

UBI-FIT can

be adjusted

to suit either left-wing or right-wing tastes, depending on the level

of basic income and the tax rate. Both of these levels would be

determined democratically, and they would also depend on each other:

the

higher the basic income, the more tax is needed to finance it.

Right-wing parties would try to reduce existing rates of basic income

and taxation, while left-wing parties would try to increase both rates.

The most important constraint in both cases would be to

balance the budget. Because UBI-FIT is much easier to understand than

the

present tax-welfare system, voters would have a clearer idea of the

issues for

which they are voting and of the possible consequences of their voting

behavior. In that sense, UBI-FIT would be more democratic that the

present

system. It would establish a level playing field for all political

persuasions.

- Economists

often misunderstand UBI-FIT. They know so much about the current system

of

means-tested benefits and progressive tax that they find it hard to

imagine what it would be like to abandon both. At first glance, the

change would appear to make much of their hard-won knowledge and

expertise obsolete. In fact, their knowledge and expertise would be

more important and valued than ever, since any transition to UBI-FIT

would

be impossible without their professional and intellectual support. The

transition would presumably need to be gradual, and it would be

important to monitor and predict every step of the way by means of

economic models.

The

following central features UBI-FIT should be understood before getting

into detail. Even if you are sceptical about UBI-FIT, please take the

time

to read and think about them, remembering that the most important aim

of UBI-FIT is to eliminate poverty. (If you don't think that is a good

aim, please keep surfing.)

- The

flat tax in UBI-FIT is not

the flat tax that

extreme right-wing

political parties talk about. They typically want a low rate of flat

tax, say 25%, and a low rate of social services. Such a tax is also effectivelyflat

- a recipe for disaster. UBI-FIT is quite different. It involves a

relatively high rate of flat income tax (say, 35% to 50%) and a

relatively high rate of social services (say, 800 to 1000 Euros

unconditional basic income for most people). The combination of these

two

means that the effective rate of taxation is (very) progressive, as

shown in the table above.

- UBI-FIT is

quite unlike those

extreme right-wing flat-tax proposals that would

cut tax for the rich and reduce benefits for the needy. That approach

would theoretically

be possible under UBI-FIT -

but so would

exactly the opposite, namely a very high basic income (say

€2000)

and a very high flat rate of tax (say 75%). In democratic practice,

extremes of this kind would be impossible, because a majority of voters

would never support them. Instead, the usual democratic processes would

ensure that the flat tax rate stayed in the vicinity of the highest tax

rates in current progressive tax scales, and basic income remained in

the vicinity of the poverty line.

- A

flat rate of income tax is easier to pay - there is no need to wait

until the end of the financial year. So it is impossible to evade a

flat tax by transferring income among financial years, income brackets,

marital and business partners, and so on.

- By

itself, a basic income is (i) difficult to finance, and (ii) can be

demotivating if associated with welfare

traps, as

in the current system. These disadvantages disappear when basic income

(i) is accompanied by a relatively high, flat rate of income tax and

(ii) is universal and unconditional.

- UBI-FIT is

efficient.

It would greatly reduce the administrative cost

of implementing the current tax-welfare system, both for the state and

for individuals - which could lift the entire economy.

- UBI-FIT could

effectively eliminate

poverty, which would be an

enormously positive achievement. In spite of the generally high

standards of living achieved by modern post-industrial societies, they

have so far failed to eliminate poverty - or at least reduce poverty to

a level that is somehow tolerable or defensible. There are still people

in our midst who do not have enough money to put a roof over their head

or to buy a decent meal. That is not only embarrassing - it is a

scandalous. It suggests that the many good intentions built into

current system are hiding an underlying moral bankruptcy. UBI-FIT

offers a realistic

solution to the whole

problem of poverty. It does not treat a

part of the problem and forget the rest. It does not merely treat the

symptoms - it addresses the causes. UBI-FIT assumes (and demonstrates)

that it is not the fault of the poor that they are poor - as many

conservatives believe - but the fault of the system in which they find

themselves. UBI-FIT would not alleviate poverty temporarily or

partially,

but completely and permanently. It would not do this by applying

socialist principles alone, but by harnessing the power of capitalism

in the service of socialism.

The underlying philosophy of UBI-FIT

In

modern democracies, the relationship between an individual's gross

income and his or her net

income is complex. It depends

on two interacting factors:

- Progressive

income tax. The more you

earn, the higher is the percentage of

your income that you pay in tax. (For example, the taxation rates

applied to different income brackets in Austria, home of the author of

this article, are here.)

But your taxable income can be reduced in innumerable ways, called tax

deductions. The rich often pay surprisingly little tax, because they

are most skilled at reducing their taxable income, or have access to

the best advice on how that can be done. For example, they may shift

income from one year to another or from one person to another, to avoid

the high tax rates of high income brackets.

- Means-tested

benefits. If you are

unemployed or the parent or guardian of a

child, you are entitled to social welfare benefits. If you are

unemployed and get a job, or if your child earns money or moves out,

you may lose that benefit at some point. Just exactly where that point

lies depends on the current legal situation, and it is determined by a

public servant. Depending on the system, you may lose the benefit

gradually or suddenly as your situation changes. If you can afford a

good accountant, you may be able to keep the benefit as your income

increases, simply by rearranging your finances.

Enormous

amounts of time and energy are devoted to the management of these two

factors:

- Progressive

income tax. The average

employee presumably spends at least

one

working day per year preparing tax returns and/or employing accountants

to do this task for them. This applies even if they employ consultants

to help them. Governments employ thousands of bureacrats to

check

these

calculations and initiate legal proceedings against tax dodgers. A lot

of this time and effort could be saved if tax was paid as soon as the

money was earned and yearly declarations were avoided.

- Means-tested

benefits.

Countless bureaucrats spend enormous amounts of time

and public money deciding who should receive welfare benefits and who

should not. In so doing they infringe the

privacy of the recipients and damage their self respect, which

reinforces class differences. Not only that - their decisions often

seem arbitrary and unfair. And the system encourages people to lie

about their income, which encourages and maintains a culture in which

lying, deception and secrecy are considered acceptable behaviors,

especially when applied to money and wealth. Chronic poverty is an

integral part of such a culture.

Much

of this effort is pseudowork.

It does not directly generate

wealth or quality of life. Much of it could be prevented if the system

were radically simplified. But would a simpler system be as fair? I

argue that a radically simplified system would be even

fairer than

the present system, if it did the following two main things:

- The socialist goal. The reform should significantly

reduce or eliminate

poverty. The gap between rich and poor appears to have been steadily

growing in recent decades. The means to effectively eliminate poverty

are clearly

available. It would cost the rich relatively little, and the benefit

for the poor would be enormous. What is lacking is the political will -

and a suitable and effective procedure.

- The

capitalist goal. The reform

should provide incentives for all

members of society to improve their productivity, which in turn

improves general quality of life. Capitalism should not generate

poverty, as it often seems to do. Instead, it should generate the means

to eliminate it.

These

two aims should not be regarded as contradictory. The key to a radical

simplification of the tax/welfare system is the recognition that

socialism

and capitalism are not mutually exclusive, but complementary.

History has shown time and again the one cannot exist without the

other. Thus, an effective tax/welfare system should not pit these

principles against one another, but instead integrate them seamlessly.

What

are the main features of ideal socialist and capitalist societies?

Opinions differ, but here is a possible interpretation:

- In

a purely socialist society, everyone is regarded as valuable,

regardless of much or how effectively they work. So the state gives

everyone the same income, which covers their basic needs.

- In

a purely capitalist society, a person's value depends only on her or

his productivity as determined by a free (unregulated) market place.

Individual incomes reflect this underlying assumption. Everyone,

regardless of income, is strongly motivated to work harder and increase

their income. Their very survival may depend on their productivity.

History

has shown that neither of these "pure" systems is stable. The purely

socialist society is unable to sustain itself, because it does not

motivate its citizens to work. The purely capitalist society destroys

itself as extreme social injustice leads to violence. Clearly, a

compromise is necessary. Modern

tax/welfare systems incorporate both the socialist and the capitalist

principle, but they combine them in a complex way. There are

innumerable ifs and buts. The loopholes accumulate as politicians try

to win elections by wooing specific groups of voters with financial

rewards and moral proclamations. The tax dodgers and welfare abusers

then find and take advantage of the loopholes. Imagine what would

happen if such populist political tactics were no longer possible, and

all those ifs and buts were removed. Too good to be true?

The main financial details of UBI-FIT

Transparency

and democracy. Democracy

only

works when the voters understand the issues upon which they are voting.

A truly democratic tax and welfare system must therefore be as simple

and transparent as possible. Since the relationship between gross and

net income is inevitably a mathematical

relationship, we may

ask the following questions: (i) What is the simplest,

most transparent mathematical formulation of the complementarity of

socialism and capitalism? (ii) What is

the simplest,

most transparent relationship between gross and net

income? The

following graph answers both questions:

The

expression "gross income" on the

horizontal axis

refers to all

monthly income

before UBI-FIT,

i.e. not including the basic

income. The expression "net

income" means

on the vertical axis means monthly income after UBI-FIT, that is after

basic income has been added

and tax taken away. Under UBI-FIT, basic income and tax are always

considered together.

The

graph presents a fictitious relationship between gross and net income

that is surprisingly close to the relationship as it already exists in

modern democracies. Those with no gross income at all generally qualify

for some kind of welfare benefit. Those on higher incomes pay tax at a

rate that effectively increases as their income increases (progressive

tax scales) and approaches some 40-50% in the highest income brackets.

The

relationship between gross and net income in modern western democracies

is complex, because benefits are means-tested: you lose your benefit -

either suddenly or gradually - when you earn too much money. Here, I

have replaced this complex relationship by a straight line of best fit.

This line eliminates the welfare

trap associated with

means-tested benefits.

- The

line crosses the vertical axis at a point called basic income or guaranteed

minimum income. For the purpose

of argument, basic income is set

here at a €1000 per month, just above

typical European estimates of the poverty

line. The

exact value of basic income would depend on how much society can

afford, that is, how

much tax the middle and upper classes are able or willing to pay.

Basic income is

defined to be universal

and unconditional:

all

people receive it, regardless of their other income (or lack thereof).

The only condition is the honest declaration of all income and payment

of income tax.

- The

tax is flat in the sense that the line is straight, but progressive in

the sense that it does not go through the origin (where the axes

cross). For the purpose of argument, the flat

rate is set in

the graph to a relatively high rate of 50%; I could equally well have

chosen 45% or 40%. The effective

rate of tax for

individuals is always lower than the flat rate.

What the flat rate means is that when your gross income increases by

€1, your net income always increases by the same amount (in

the

graph, by 50 cents) - regardless of how much you are already earning.

It applies not to your overall income, but to changes

in your

overall income, and hence to the incentive to work. The gradient of the

line in the graph is inversely related to the tax rate: if the gradient

is steep, the tax rate is low, and if it is shallow, the tax rate is

high.

- The

point at which gross and net income are the same is called the break-even

point. In the above graph,

it is €2000 per month.

In general, it may be calculated simply by dividing basic income by the

tax rate: for example, €1000 divided by 50% (one half) equals

€2000. The break-even point rises with increasing basic income

and

with decreasing tax rate (or a steeper line).

The

diagonal line on the graph is the "bottom

line". The important thing

about the above graph is not the

specific values of the two parameters "basic income" and "flat tax",

which can be misleading when taken out of context, but the specific

relationship between gross and net income (the line on the graph),

which in the end is all that matters. For example, if your gross income

(not including basic income) is €3000, according to the graph

above you would take home a net income of €2500. At the end of

the

day, it doesn't matter whether you (i) pay €500 in tax in the

current system or (ii) pay €1500 in tax and receive

€1000 in

basic income under UBI-FIT.

What

exactly is basic income? "A

basic income is an income

paid by a political community to all its members on an individual

basis, without means test or work requirement"

(Van Parijs, 2000,

p. 3).

Under

UBI-FIT, everyone

would receive a basic income,

regardless of

their current income - even the rich. For high income earners, basic

income would be deducted from their total tax bill, and would therefore

be a kind of negative

income

tax.

For low income earners, basic

income would correspond

roughly to the existing concepts "poverty line", "long-term

unemployment benefit", and "welfare benefit" and would make some of

these concepts obsolete (or change their meaning). If everyone had

access to an income corresponding to the poverty line, poverty would be

effectively eliminated.

Can

poverty be eliminated? It depends what you mean by poverty, which in

turn depends on the definition of the poverty

line or

(poverty threshold). The monetary value of the poverty line (in

currency units per unit time) depends on the general standard of living

in a given country: in poor countries, the poverty line is lower than

in rich countries. The poverty line is determined not only by the cost

of essential goods and services in a given country, but also by

perceptions of what is "essential" for an adequate standard of living

in a given country. In the end, the poverty line is determined by

consensus among experts, some of whom perceive it as higher and some as

lower. The value usually quoted may thus be regarded as an equilibrium

between competing perceptions. Poverty is relative in other ways as

well. A person who has enough money to live on but lacks basic

financial management skills or rejects interesting opportunities to

supplement her/his income may appear

to be poor.

Everyone has

(or should have) the freedom to self-define as "poor" or to

deliberately avoid meeting their basic needs and therefore to appear to

be "poor". If the poor (or under UBI-FIT, everyone) received a basic

income, perceptions of basic needs would change, increasing the

monetary value of the poverty line and perhaps making it impossible to

completely eliminate poverty. Given these uncertainties, it might be

more accurate to claim that UBI-FIT would come as close to eliminating

genuine poverty as is reasonably possible.

Parents

would receive basic income both for themselves and their children.

Thus, basic income would also replace current child benefits. At a

certain age (probably 18), children would be required to open their own

bank accounts and receive the basic income directly.

The

exact amount of basic income for the average person would be determined

by the usual democratic processes. Left-wing political parties would

try to increase basic income (and increase the tax rate to cover it),

right-wing parties to decrease basic income (and reduce the tax rate

accordingly). It might

also be a good

idea to legally define the outside limits of these parameters: e.g.

basic income should never fall below 80% of the poverty line (given a

well-defined procedure for determining the poverty line) and the flat

rate of tax should never exceed 50%.

Basic

income would depend on the ability

to

work:

pensioners and the disabled would receive more. Exactly how this would

work is beyond the present scope (but see the paragraph on pensions

below). Basic income would not depend on willingness

to work. "Willingness to work" is an unsuitable criterion for a social

benefit for the following reasons:

- "Willingness

to work" is difficult to determine. On the one hand, nobody wants to do

boring or unrewarding work. For this reason, everyone can be expected

to lie about their willingness to work, the rich included. A system in

which people are expected to declare their willingness to work is a

system that cultivates a culture of lying. On the other hand, everyone

wants to have more money and in that sense everyone is willing to work.

Rather than trying to measure the unmeasurable at the level of

individuals, the state should be trying to increase everyone's

willingness to work.

- "Willingness

to work" is expensive to monitor. It costs a lot of money to keep track

of the job-seeking activities of thousands of unemployed people. Which

applicants attended which job interviews? Did they really attend them

or merely claim to have done so? Should their unemployment benefits be

discontinued? If so, what benefit will replace them? What are the

consequences of the poverty created by the discontinuation of

unemployment benefits and what measures are needed to deal with it?

These are difficult questions, and it costs money to answer them.

- "Willingness

to work" is none of the state's business. Why should the state pry into

the private lives of individuals? This practice contradicts the basic

principles of individual freedom, privacy and mutual respect upon which

modern democracies are built. Moreover, since some people are subject

to this prying and others are not, it may be regarded as a form of

discrimination. Nor is a person's living situation - with whom one is

living, how many people live in the same house or flat, whether parents

are married, whether a relationship is heterosexual or homosexual, and

so on - any business of the state. Besides, one might argue that those

who choose to live together, which is financially more efficient,

should be rewarded for their initiative and not punished.

- "Willingness

to work" ignores people who voluntarily do unpaid work such as

childcare, domestic duties, and study. The current system treats these

people as if they were "unwilling to work": they are not eligible for

unemployment benefit. But if not for these people, society would

crumble. In fact, there would be no society. They deserve at least a

basic income. Consider the following examples:

- If the

birthrate is too low, it is because

potential parents

and particularly potential mothers are unhappy with what society is

giving them in return for the effort and expense that goes into raising

children - not to mention the effect that it can have on the parent's

career. It is therefore in the interests of the whole society that both

parents and their children receive an unconditional basic income. Not

only that - all governments should follow Sweden's lead and guarantee

good, inexpensive child care for every child. One could even argue that

free

child care should be available to

all, at least

for five half days per week, which would cost some €300 per

month

per child and be financed by a combination of income, capital gains and

wealth taxes. That would end the discussion about the difficulty of

combining family and career and the effect on the birthrate. Children

and their parents are surely important enough for their basic needs to

be met. We are not talking about luxury!

- The

efficiency and creativity of the

workforce depends on the

number of people with tertiary qualifications. To get a tertiary

qualification, you need to study at university, and to do that, you

need enough money to cover your basic living costs while you are

studying. It is therefore in the common interest that students receive

an unconditional basic income. Following this argument, they should not

have to pay tuition fees, either. The running costs of universities can

be met by combination of government and private sources. Students are

surely important enough for their basic needs to be met. We are not

talking about luxury!

Basic

income may also depend on age.

Some argue that children

generally spend

less money (or cause less money to be spent), so basic

income should be lower. Perhaps the real reason behind this assumption

is that children have less political power. But one can equally argue

that basic income should be higher

for children

than for

adults:

- I

have argued that basic income may depend on ability to work, but not on

willingness to work. Since children are unable to work (child labor is

illegal), they should receive more basic income than adults.

- Single

parents and in particular single mothers belong to those most at risk

of poverty. They need their children's basic income to survive.

- Although

children usually eat less than adults and their clothes may be

cheaper, adolescents may eat more than adults, and growing children

need new clothes more often.

- In

many industrial countries, the population is decreasing. A high basic

income for children could help to increase the birth rate.

- If

parents were to earn only 1 Euro per hour (!) for looking after their

children - for about 16 hours per day and 30 days per month - we are

already looking at about 500 Euros per month, without considering food,

clothes, rent, school, toys and so on.

Balancing

and comparing the various arguments, it may be both fair and realistic

to make basic income independent of age, at least for children (The

question of basic income for pensioners is considered below). A system

with fewer variables is more transparent and easier (cheaper) to

manage. Remember that each variable would be periodically adjusted in a

time-consuming political process. If the basic income for children is

the same as for adults, the system contains one less variable.

Finally,

basic income may depend on gender.

The average women

still earns considerably less than the average man for the same work,

in spite of decades of attempts to solve this problem. So perhaps women

should receive more basic income (or pay less tax - see below) in an

attempt to redress this imbalance.

These

details would have to be decided in a democratic process. I am

concerned here only with the general principle of UBI-FIT, which

involves

a radical change in current thinking. There is little point discussing

the details until the basic concept is understood, which is a big step.

Balancing

the budget. When basic

income is set at €1000 and flat

tax at 50%, the numbers are round and calculations are easy. Of

course these figures would have to be adjusted in a political process

and would be different from one country to the next. For

Germany, Strengmann-Kuhn (2006)

calculated that a basic income of €500 per month could be

financed

by a flat tax of 35% (a typical right-wing setting of the two

parameters), and a tax rate of 50% could support a basic income of

€800 (a typical left-wing setting). For this

calculation he

assumed that children receive half the basic income of adults.

Pseudowork.

Following the introduction of UBI-FIT, those many bureacrats who

currently

decide whether people get welfare benefits, and who check tax returns

for accuracy and fraud, would need to be retrained to do something more

interesting and productive, such as monitoring the introduction of the

new system and its many social and economic effects. Tax advisors would

similarly find themselves moving into new domains.

Resistance

and misunderstanding. It's

not easy to understand UBI-FIT when

you are used to the current system. Both capitalists and socialists

tend to object, sometimes vehemently.

- Capitalists

may object to a basic income. Would it be wise to give everyone a

handout, themselves included? Surely that will reduce the incentive to

work - across the board?

- But the

incentive to work depends primarily

on the gradient

of the line in the graph and not

on the point at which it crosses the

vertical axis. The big advantage of UBI-FIT from a capitalist viewpoint

is

the constant incentive,

regardless of income. Everyone is

equally motivated to work and no-one feels the system is unfair.

- Besides,

the security of basic income makes

it easier for

people with lower incomes to take risks and develop the entrepreneurial

spirit that is needed to create successful new businesses.

- Socialists

may object to a flat tax because it is associated with laissez-faire

capitalism in which the rich get richer and the poor get poorer.

- But the

above graph shows that when you make

the relationship

between gross and net income linear (i.e. a straight line whose

gradient depends on the tax rate) and shift

it away from the origin (the

bottom left of the graph, where

both axes are zero) by an amount

corresponding to the basic income, the result is mathematically

equivalent to a progressive tax scale.

- Besides,

progressive tax systems have not

been very

successful in reducing the gap between rich and poor. That is

presumably because the rich can more easily afford good accountants,

who work out sophisticated ways of evading tax. This problem can be

addressed by making the system simpler and more transparent, which

gives the majority more power to reduce the gap between rich and poor

by ordinary democratic processes.

- Finally,

UBI-FIT treats

everyone equally even though

some are rich and some and poor. UBI-FIT spans the entire spectrum from

the ideal communist concept of constant income throughout society to

the ideal capitalist concept of zero social benefits and low flat tax.

In every case, it treats everyone equally. But it also gives people the

power to determine the right position between these extremes by

democratic means. If this procedure is truly democratic - that is, if

all people can have an equal influence on the decision, regardless of

income - the result is bound to lie in the interest of lower income

earners, since they represent the majority.

Once

the concept of UBI-FIT is understood and the above misunderstandings

overcome, resistance to it is expected to come mainly from the rich. In

spite of the inclusion of the capitalist concept of flat tax, the

UBI-FIT

concept is primarily a socialist one:

- UBI-FIT has

the potential to

eliminate poverty (depending on how poverty is

defined), which is an issue of central concern to the political left.

- UBI-FIT would

simplify the

tax-welfare system, with the result that more people

could understand it. That would reduce the current advantage enjoyed by

those with better education (to understand the intricacies of the

current system) or financial resources (to employ accountants to manage

their finances).

The

right wing should nevertheless be pleased about the following central

features of UBI-FIT:

- Small

government: a significant reduction in the amount of pseudowork

(bureaucracy), and hence in the size of the public service

- Personal

freedom: a significant decrease in governmental interference in private

lives of individuals

- Incentive:

The current system motivates welfare recipients not to work - for if

they work, they risk losing their benefit, or their benefit may be

reduced. For them, the line on the above graph is horizontal or even

downhill. UBI-FIT would ensure that everyone is financially rewarded

for

extra paid work, and to the same degree.

Eliminating

welfare traps. A welfare

trap (aka poverty

trap or unemployment

trap)

is a situation

that discourages people from accepting offers of employment because

their total income after accepting the offer would not increase enough

to make the change worthwhile. In deciding whether to accept a job

offer, they must take into account their total income from all sources

- including the means-tested welfare support, their new income, any

income they would lose due to the reduction in their free time, and any

new costs such as the cost of child care for parents (especially single

parents).

Anyone

who has ever received welfare benefits knows what a welfare trap feels

like. As every good capitalist knows, or should know, welfare traps are

bad for business, because people who could be working are encouraged to

stay on welfare instead. Not only that - a system that motivates people

to do whatever they can to maintain their welfare benefits promotes a

culture of dependency and deception.

The

rational solution is not to reduce the amount of welfare, but to

straighten out the line on the graph of net income against gross income

so that no matter what your gross income is, you will always increase

your net income significantly by increasing your gross income. That

way, everyone is motivated to work, which will eventually increase the

gross national product and hence the standard of living of everyone.

UBI-FIT abolishes

all welfare

traps. Given the central importance of this

point, objections to the system are unlikely to be well unfounded. What

could possibly be wrong with taking the current relationship between

gross and net income in a given country and drawing a straight line of

best fit through it? Any objection to that would be an argument in

favor of bending that line, which goes against fundamental economic and

democratic principles. The economic or capitalist principle is that

every bend creates a welfare trap or other disincentive, for a given

socio-economic group (defined purely according to their income). The

democratic or socialist principle is that there can be no good reason

for negatively targetting any socio-economic group.

Both

socialists and capitalists will agree that a tax-welfare system should

allow and even encourage socioeconomic mobility. There should be no

barriers to those striving to change their "class". UBI-FIT promotes

socioeconomic mobility by removing all correlates of socio-economic

class from the tax-welfare system. Both means-tested benefits and

progressive tax scales are completely avoided.