|

|

Eliminate Poverty

with

BIFT

Universal Basic Income and Flat Income Tax

Armut

abschaffen mit bedingungslosem Grundeinkommen und pauschaler

Einkommenssteuer

Richard

Parncutt 2011,

revised 2019

Another text about the same idea: html

Presentation at BIEN

Munich 2012 - pdf

- ppt |

Before reading this, read this

In France, the gilets

jaunes are asking big

questions about

welfare and taxation. How can the system be reformed so working-class

and (lower-)

middle-class people feel fairly treated?

There's a simple answer that hardly anyone is talking about. What if

everyone, rich and poor, paid half of their regular income (not

including the basic income) back to the government as tax? What if,

in return, the government gave

everyone,

rich and poor, a basic income of €1000 per

month, no questions asked? In other

words,

what if a universal basic income (BI) of €1000 per month was

combined with a

flat income tax (FT) of 50%?

The numbers

in this example (€1000 and 50%) are

arbitrary. They have been chosen for illustration. They would be

adjusted in a democratic political

process. The

value 50% is

probably too high; depending on the level of basic income and other

taxes and government expenditures, 40%

might be enough to balance the books. There are other

issues to address such as how much basic income to give children,

pensioners, and non-nationals, implications for the migration

of

people and corporations, levels of corporation tax, and so on. But

let's focus for the moment on the effect of such a reform on the

majority.

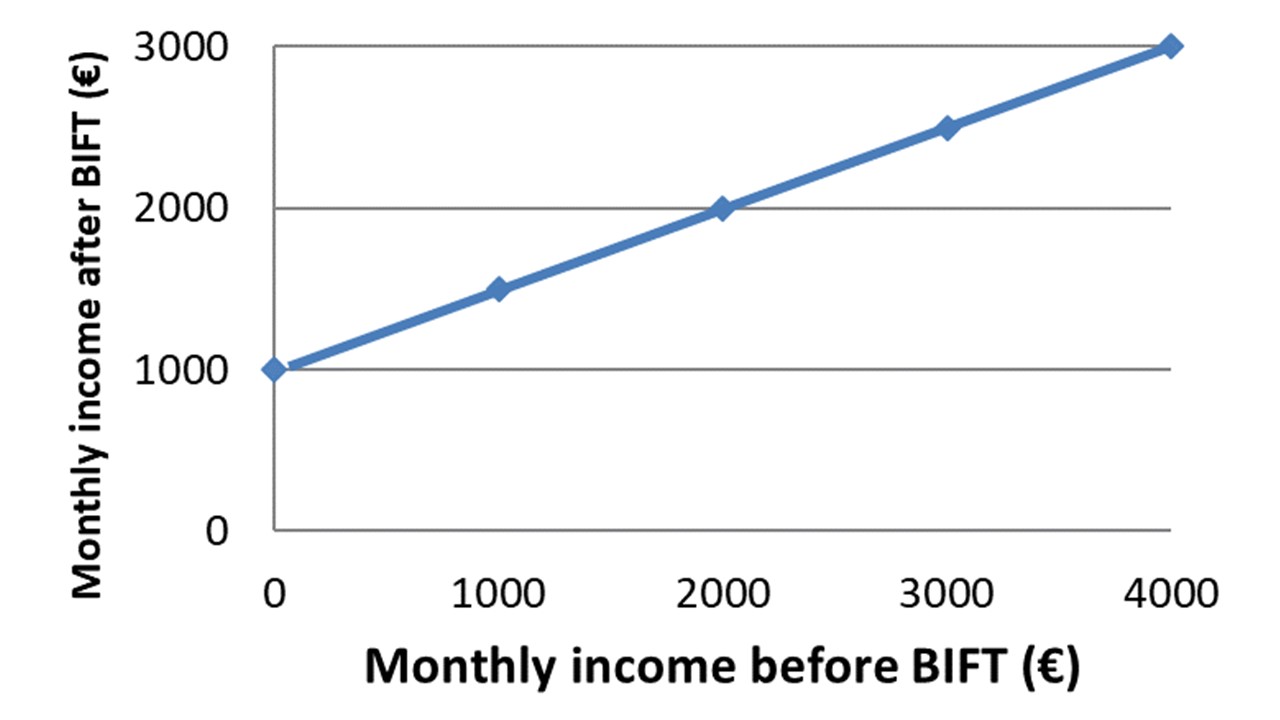

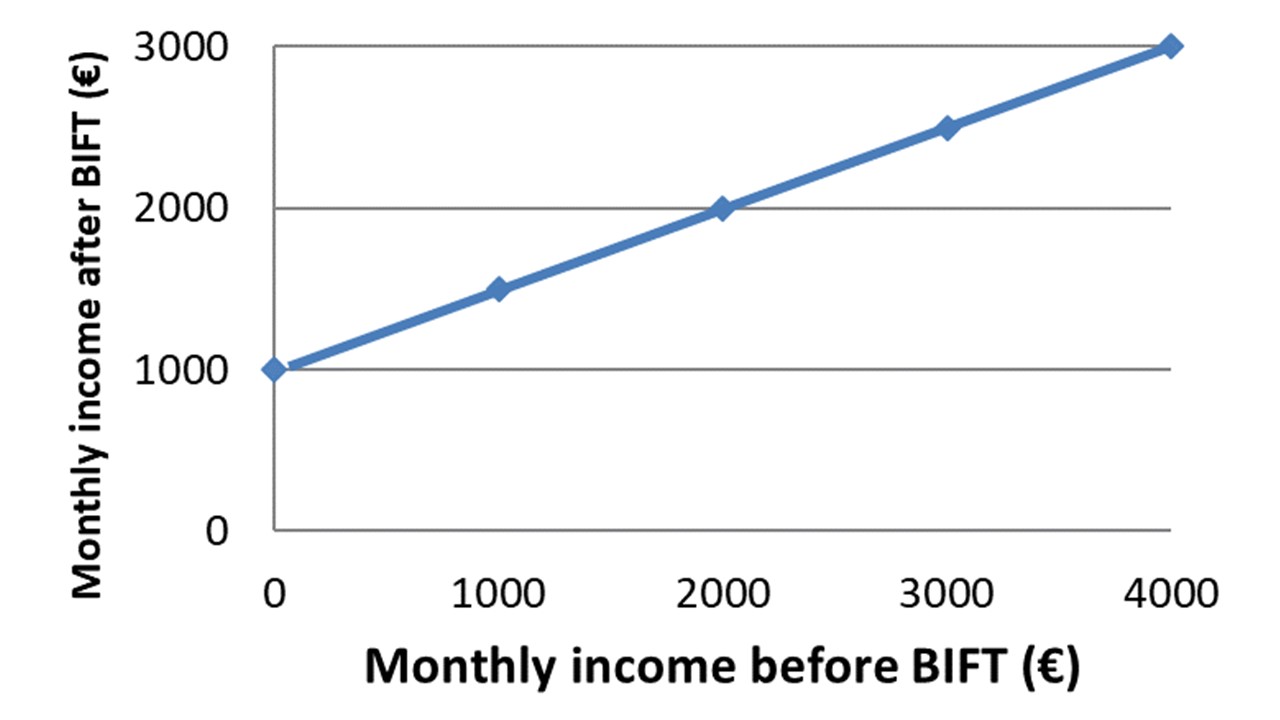

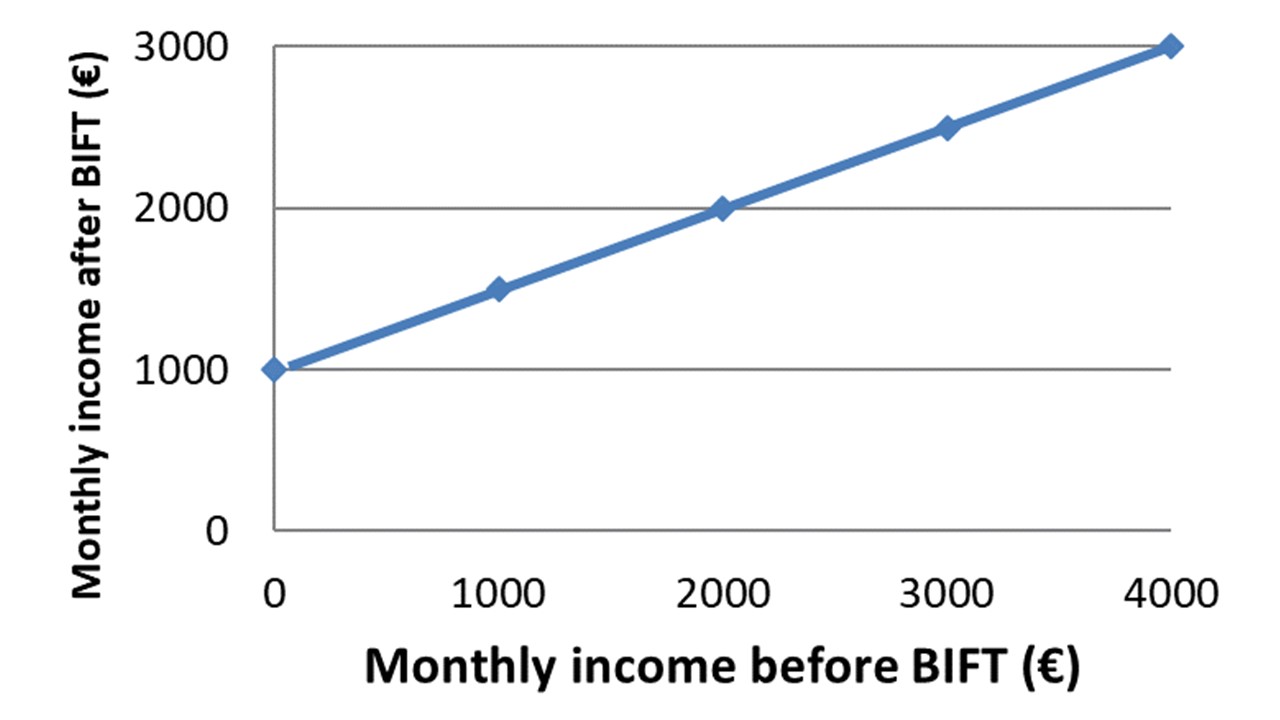

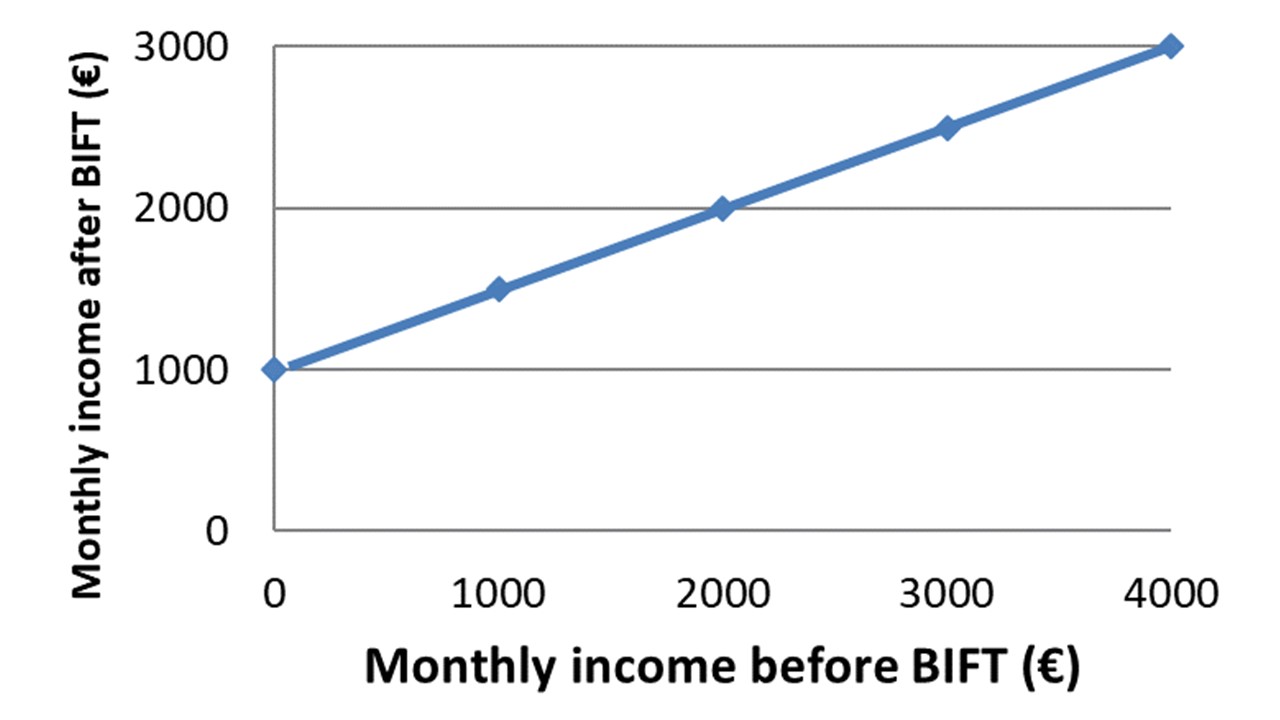

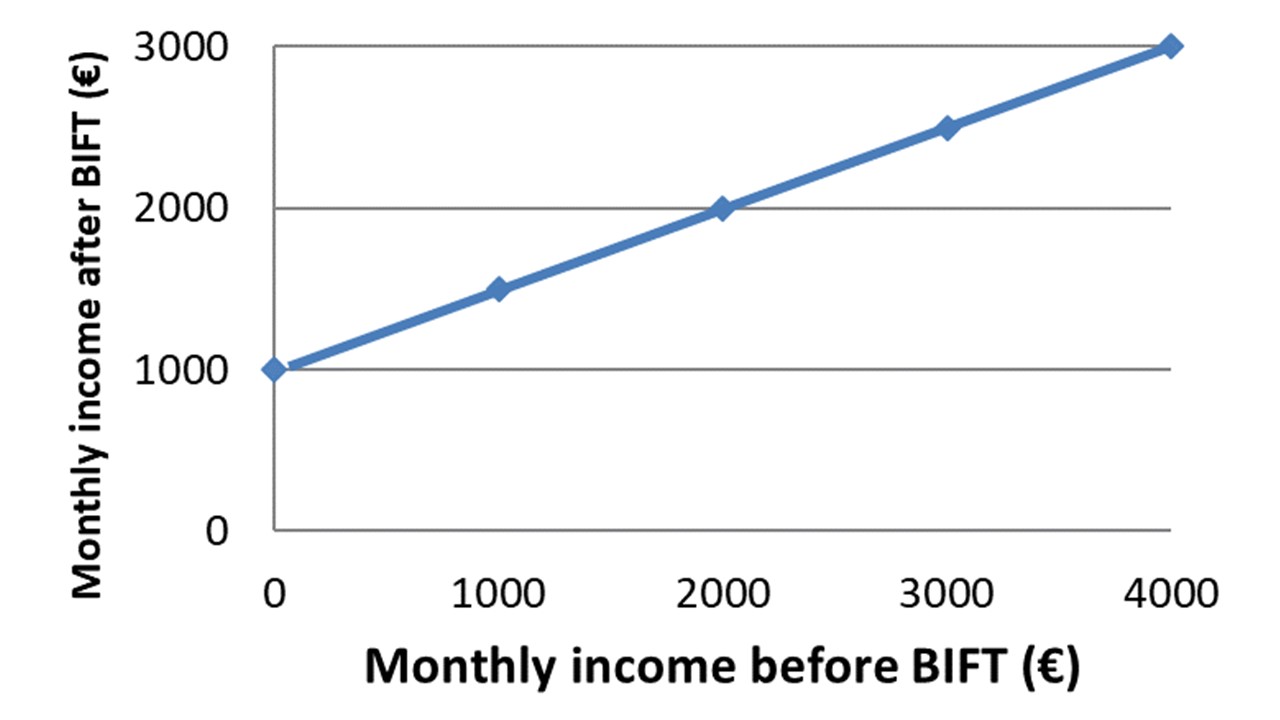

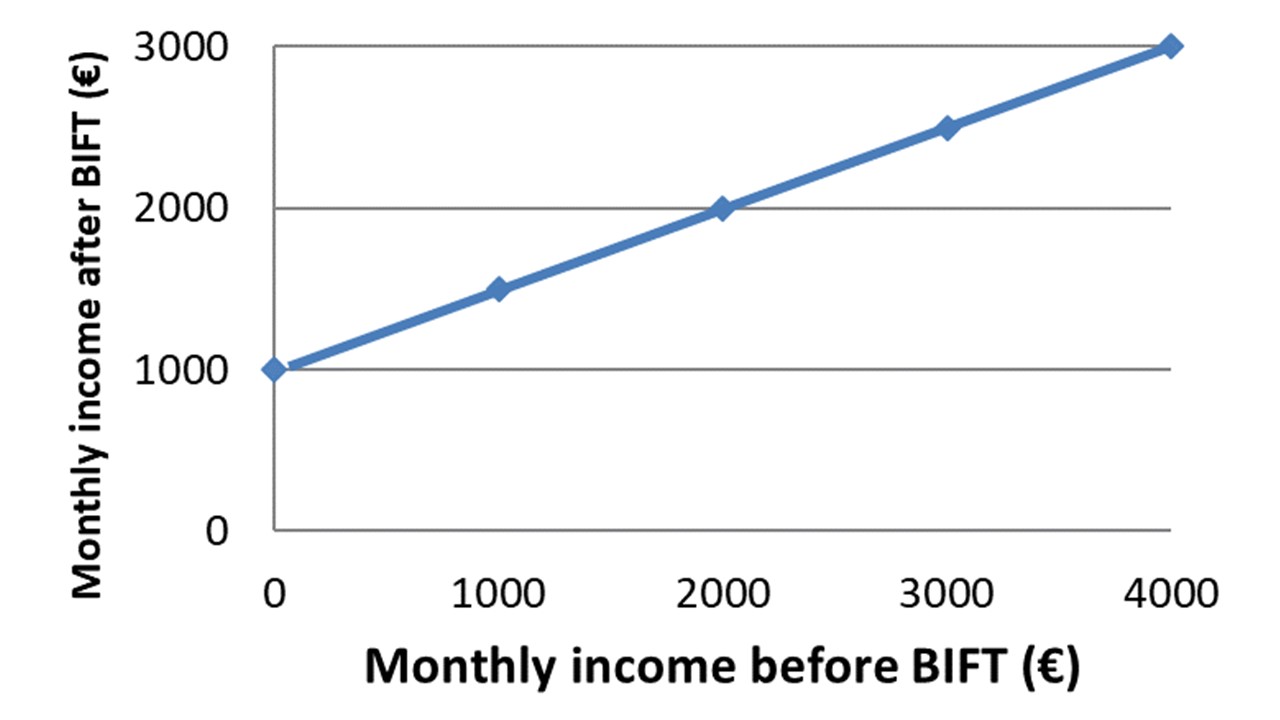

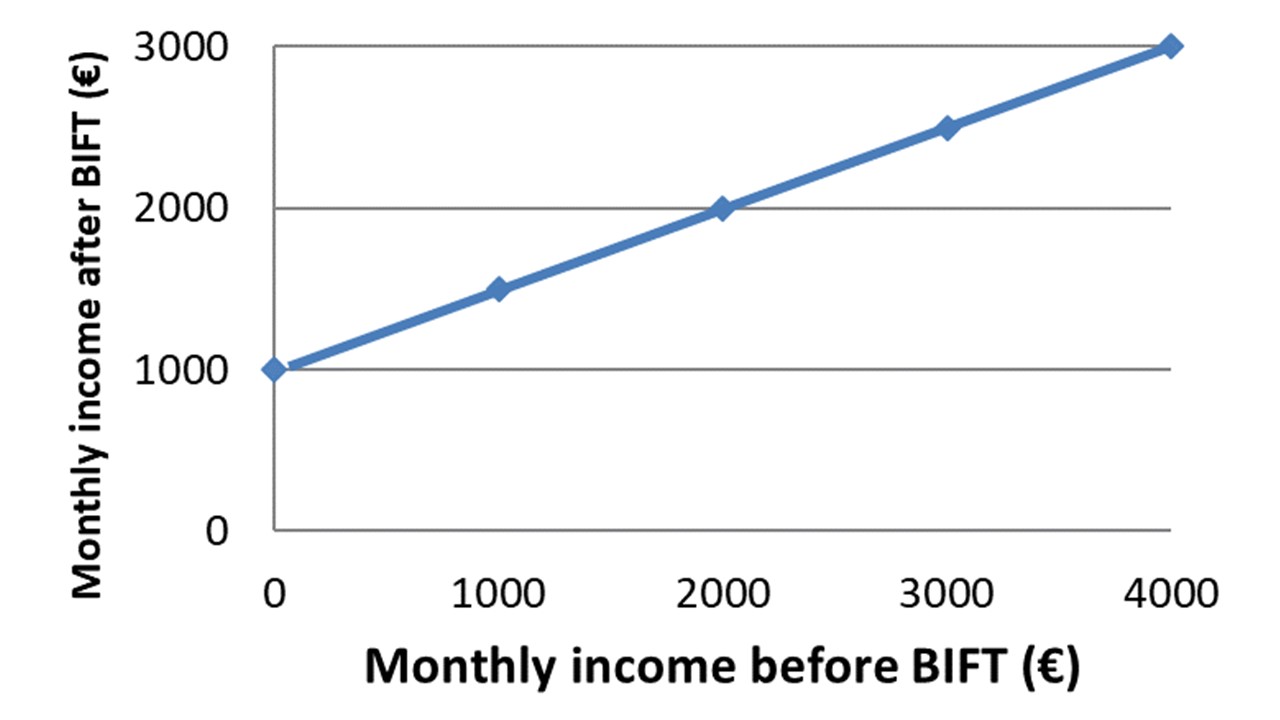

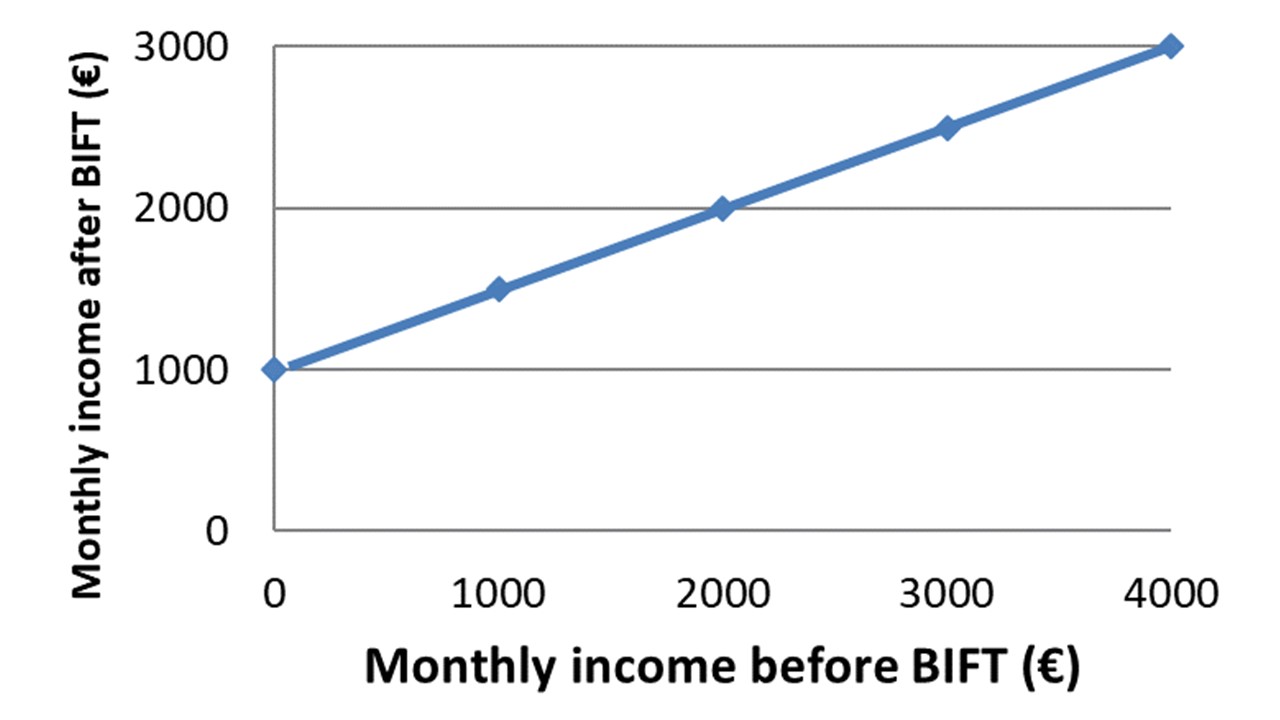

The

above graph encapsulates the main idea. The horizontal axis ("monthly

income before BIFT") is

the total amount of money an individual earns from any sources

other than welfare/BI: wages, independent enterprise, interest, capital

gains. The

vertical axis ("monthly income after BIFT") is disposable

income: the total amount of money

an individual can spend, after FT is subtracted and BI is added.

Here, BI and FT are always considered together. It makes no sense to

consider them separately. Hence the acronym BIFT. Because we are so

used to the current system of giving here and taking there, this idea

may be difficult to grasp at first. To understand BIFT, it is important

to

focus on the

ascending line on the graph

rather than the numbers (BI

and FT) behind it. In the end, only the line oin the graph counts.

What if this kind of reform actually happened? Several major problems

would be solved simultaneously:

- the

end

of poverty: basic income would correspond roughly to the poverty line

- a

smaller wealth gap: less difference between rich and poor

- a

smaller gender wealth gap: less difference between disposable male and

female incomes

- universal

work incentive: no welfare

traps (you don't lose your

benefit as your income increases)

- more

freedom: work as much or as little as you want; no

stigmatisation of unemployment

- less

meaningless bureacracy and invasion of privacy by tax and welfare

offices

- more

democracy, because a simpler system is easier for voters to understand

- less

power for the far right: fewer deeply dissatisfied citizens for

populist politicians to prey on

- more

power for democratically elected governments and less for corporations

(e.g. to address climate change)

Too

good to be true?

BIFT

and the far right

The

rise of the far right has brought us Trump,

Bolsonaro, and Brexit, not

to mention Lega Nord, FPÖ, AfD, Golden Dawn, Le Pen,

Orban,

and countless

others.

The

far right is steadily undoing decades of social-democratic

progress made by previous centre-left governments, which is exactly the

opposite of what most far-right voters need. The far right is also

preventing projects to mitigate climate change. If the current fashion

for

imitating 1930s Germany continues, the results will be

catastrophic.

If we ask why the far right is so popular, different people

give different answers. The far-righters themselves tell us that

"foreigners"

are (i) taking their jobs, (ii) diluting their culture, and (iii) even

killing people

(terrorism). These misleading ideas come from private media such as

the Murdoch press, which are controlling public opinion to

serve

the interests of rich elites, just as political media in Eastern Europe

used to control

public opinion to serve the interest of communist rulers. In fact,

"foreigners" are (i) doing work that locals don't want to do (such as

caring for the elderly), (ii) enriching local cultures everywhere, and

(iii) often fleeing from terrorists themselves.

Apart from the lies and distortions spread by the media, the main

reason people are voting for the far right is presumably money. In the

1930s, a global depression was

causing widespread unemployment. In Germany, Nazi conspiracy theorists

blamed international Jewish networks for the 1929 crash. That was

nonsense, but many Germans were looking for scapegoats and believed it.

Meanwhile, the allies (including France, Britain, and Russia) had

irrationally declared the Germans and her allies to be responsible for

the Great War in the

treaty of Versailles,

forcing them to pay massive reparations and shifting their borders.

Without the depression combined with Versailles, the fascists

(Nazis) would never have come to power.

Today, the gap

between rich and poor (the "wealth gap") is growing in countries such

as the US and the UK (more).

In other countries, the income of working classes is stagnating or even

falling in real terms. The unemployed and

working poor are being unfairly treated, and they know it.

Globalisation has left them in the lurch. Looking for scapegoats,

they are blaming "foreigners".

The unemployed and working poor should instead be blaming the rich, who

are

promoting and defending an unfair economic system. The global rich do

not belong to a specific religion or cultural group, nor are they

working together against the rest of us (there is no conspiracy). It is

nevertheless true that the global rich are collectively responsible for

the growing wealth gap and all the problems that is causing, because

they are best placed to solve it.

Why is the wealth gap growing?

One reason is globalisation. The rich have more access to international

markets. Digital technology has helped them to

increase profits

without passing them onto workers (there is seldom a "trickle down

effect"). The rich

are increasingly

avoiding taxation by transferring their wealth to secret accounts in

foreign countries. That

includes many leaders of developing countries whose people are living

in poverty: tax havens cause poverty (more).

On these points, most governments are

dragging their feet and hardly anyone is telling the truth. The facts

are clear: All tax

havens could and should be closed down by international agreement. Bank

secrecy should

be ended worldwide. The

rich should obey the law like everyone else. Tax criminals should be

identifed and fairly punished. Our

governments should be implementing

globally harmonized

wealth

taxes

(more).

In general, the amount of tax that an individual pays should depend on

their ability to pay, which depends on both wealth and

income.

The

rich

like things the way they are, and they are pulling the strings in the

background. That may seem like a hopeless situation, but the

rest

of us still have our freedom of speech. If enough of us start telling

the truth, the system will change.

Is

progressive income tax

really progressive?

A well-known instrument to reduce or control the wealth gap is

progressive income tax. If your income is low, you pay no tax.

The

higher your income, the

higher the proportion you pay in tax. The tax rate increases from one

tax bracket to the next.

The rising wealth gap means that progressive income tax is not working.

Here are two possible reasons for the failure of progressive income tax

to stabilize the wealth gap:

- In

the UK, VAT (20% on most goods and services) is exacerbating poverty.

The same applies to many countries (but not the USA, which has no VAT

and sales taxes are lower). In the UK and other countries with

high VAT, people with low incomes pay a higher

proportion of their income in VAT than people with

high incomes. In other words, VAT is regressive,

and the

regressivity

of VAT can completely cancel out the progressivity of income

tax (more)!

In the end, people are effectively paying about the same rate of tax on

every dollar they earn. The obvious solution is to get rid of VAT, but

no-one is talking about that, because the rich like it. The more money

the government gets from VAT, the less they need from the rich.

- The

culture of

tax deductions

favors the rich. Details vary from country to country (more),

but the general principle is the same.

If I buy a piano to give music lessons, I can deduct the cost

of

the piano from my income and pay less income tax. That seems fair, but

it is not. First, the

rich are more likely to be working independently or starting new

businesses, generating costs that can be deducted. Second, the rich can

afford better accountants who know how to manipulate the tax-deduction

system. In this way, tax deductions primarily benefit the

rich (more). If I

need a piano to give piano lessons and I have no money, I

should not get a tax deduction. Instead, I should borrow the money and

pay it back from my earnings. That's what banks are for. The same

applies to any expenses incurred to produce additional income. A

simpler, fairer system with lower tax rates and no tax deductions at

all is possible, but no-one is talking about it. The rich want to pay

as little tax as possible, while at the same time keeping the public in

the dark about what is really happening.

These are central problems in modern international economics

and politics, and although the task seems enormous, it is possible to

solve them.

The following figure, copied from the Austrian newspaper Der Standard

on 8

January 2019, illustrates the problem. The vertical axis is

the percentage of income that each Austrian effectively pays in tax.

The

horizontal axis is income, starting with the lowest 10% of people and

ending with the highest 10%. The graph shows that the rich, the poor,

and the middle class are all ultimately paying between 40% and 50% of

their income in tax. In other words, Austria is a "flat tax republic".

But the problem is not confined to Austria. The situation is similar in

most countries, including France.

The

lower red part of the graph shows the effect

of income-tax progressivity: people with lower incomes pay a lower

proportion of income as "income tax". The dark blue band at the top

shows how that progressivity is cancelled out by the

regressivity

of VAT and petroleum tax. The result is close to a flat income tax

system. No wonder the wealth gap is growing.

If

everyone is effectively paying almost 50%

of their income in tax and receiving all kinds of government

benefits in return, the current system is already remarkably close to

BIFT. Why not just give everyone the same basic income, tax all

income at 50%,

and get rid of the other taxes and benefits? Of course other taxes are

necessary (environmental taxes to reduce pollution, transaction taxes

to calm the markets, wealth taxes to reduce the wealth gap), but VAT on

everyday purchases such as regular food is

certainly unfair and should be eliminated. VAT for luxury goods is ok,

especially if they cause environmental damage.

On the one hand, the gilets

jaunes

are right that it is unfair to raise the price of petrol. On the other

hand, Macron is right that carbon needs to be taxed to save the

climate. There is an easy solution: tax petrol (which is regressive)

and divide the proceeds up equally among taxpayers (which is

progressive). This idea could be applied in any country and has been

recommended by economists for the USA.

But the idea of giving the proceeds

from a tax back to citizens, the same amount per person, is the same

principle as BIFT. The current system can be radically simplified by

giving

people just one large basic income payment and canceling all other

welfare payments (exception: compensation for disabilities

that

prevent people from working), while at the same time taxing carbon to

save

the climate for future generations, as well as taxing large amounts of

wealth, international transactions, and luxury purchases.

Reducing VAT and introducing an

unconditional basic income are two promising strategies for bringing

back real progressivity and reducing the wealth gap. At the

same

time, progressive

income tax scales should be abandoned, for two reasons:

- BIFT

is inherently progressive. In the above graph, if you earn

€2000

before BIFT, you get the same amount after BIFT, so you effectively pay

no tax. If you earn €10000 before BIFT, you get €6000

after

BIFT and pay effectively 40% of your

income in tax. The more you earn,

the

higher the effective tax rate, on a sliding scale.

- It

is

simpler and more transparent to adjust progressivity by adjusting the

relationship

between BI and FT and nothing else. Voters are more likely to

understand a simpler process, which is therefore more democratic.

These

are not political demands. They are

mathematical facts.

The main aims should be

- to

make

the whole

system more progressive and not just a part of it, and

- to

simplify the system to make it harder for the rich to avoid or

evade tax.

The

red area in the above graph shows that although income tax in Austria

is progressive, the big picture is not progressive. BIFT without VAT is

a way to make the entire system more progressive. Progressivity can be

further improved by adding transaction and wealth taxes.

A

new approach to

income-tax progressivity

There many misunderstandings about tax, but there is one

misunderstanding that really takes the cake. Almost no-one understands

the following proposition. But it could be the key to eliminating poverty

for the first time! Imagine that: a world

without poverty

in which the

rich are

still rich, which makes the

proposition politically

realistic. Here it is:

Income

tax becomes progressive when

you combine BI (universal basic income) with FT (flat income

tax). BIFT is inherently progressive.

This is not a political or economic claim. It is purely

mathematical, and the maths could not be simpler. To understand it,

imagine what the world would

be like if income tax and welfare worked as shown in the

graph.

The horizontal axis is what

employees get from their

employers, before adding welfare and subtracting taxation. If you are

self-employed, the horizontal axis is what you earn in the marketplace. The

vertical axis is how much money you

can spend every month, after adding welfare to, and subtracting

taxation from, your earned income.

According to the graph, if you have no income before BIFT (zero on the

horizontal axis), you receive a benefit of €1000 per month.

This

universal, unconditional basic income is sometimes called negative

income tax.

Everybody gets it, rich or poor, so there would no longer be means

tests for benefits. Imagine that: no stigmatization and no infringement

of

personal privacy. The value 1000 is arbitrary and has been chosen here

for purpose of illustration. The exact amount would be adjusted by a

democratic political process.

In this scenario, if your income before BIFT is €2000 per

month, then your

income after BIFT is the same. The tax you pay is equal to

your basic income, so they cancel. This is called the break-even point.

As your income increases beyond €2000, you start to pay tax.

If

your gross income is €3000, your net income is €2500,

so you

are effectively paying 500/3000

= 17% in tax. If your income before BIFT is €4000, your income

after BIFT is

€3000 and the effective overall tax rate is 1000/4000 = 25%.

If

your income is much more, the tax rate approaches 50%. In other words,

the effective

tax rate

gradually increases as your income increases. This is a

progressive taxation scheme, but because there are no tax

brackets, the scheme is continuously

progressive.

The scheme has two main adjustable parameters. To draw the graph, these

have been set to 50% (the

flat tax rate) and €1000 (the basic income). These numbers are

round and arbitrary. They have been

chosen only for the purpose of illustration. I wanted to make the

graph as simple as possible, to illustrate the basic idea. In reality,

both numbers would be adjusted in a democratic political process.

Some people are worried about giving basic income to the rich. But

in this proposal the

income tax paid by the rich would be much bigger than the basic income.

What matters in the end is the relationship between income

before

and after BIFT, as shown in the graph. Welfare and tax always interact.

We need to focus on the final result

of the calculation (the "big picture") and not get distracted by

detail.

Imagine what would happen if welfare and tax really worked like this.

Everyone would be treated equally; there would be no stigma attached to

poverty. In fact, there would be no poverty at all! Everyone would get

the

same basic income (with different rates for people with disabilities

and children, see below) to cover their basic needs and everyone would

pay the same rate of tax. Everyone would be motivated to work,

so

the economy would be healthy and stable (there would be no "welfare

trap" when people

lose benefits if they get part-time work). Wage earners would not need

to file annual tax returns, because income tax would be paid in full

with every dollar earned, and there would be no tax deductions to

calculate at the end of the year.

You may be thinking that this will be too expensive. Governments won't

be able to afford it. In fact, the cost of the system depends on how

the two parameters (basic income and flat tax rate) are chosen. If the

basic income is relatively low, the budget can be balanced with a

relatively low tax rate. That's the right-wing approach. The left-wing

approach is to aim for higher levels of both basic income and tax. In

both

cases the budget can be balanced.

The

current relationship between income before welfare and/or tax and

income after welfare and/or tax is already remarkably

close to the above

graph in

most countries (some examples are below), but unnecessarily

arbitrary and complex. BIFT would simplify that. In fact, it is the the

simplest and most effective way to make income tax progressive. Consider

the following two arguments:

1. Progressive

income tax scales are supposed to benefit the poor, but in fact they

benefit the rich. Every unnecessary complexity in the system generates

loopholes that the accountants of rich people use to reduce their

taxation and thereby increase their income. A classic trick to avoid

tax is to redistribute income so it falls in different tax

brackets with lower tax rates. In the proposed system,

tricks of that

kind would no longer be possible.

2. Inherent in the current system is the welfare trap:

If you are receiving unemployment benefit and get a part-time job, you

generally lose part or all of the benefit. Often, you are better off

not accepting the job. No wonder the poor sometimes give the

impression of not wanting to work! The current system directly encourages laziness

and depression! The proposed system would make welfare traps a thing of

the past.

If the entire system was simpler, more

people would understand it and democracy would work better. If people

were paid fairly for every bit of work they did, they would be more

motivated. But the rich

evidently don't want either of those things to happen, which is why we

are struck with the current problematic system.

The

gender wealth gap

Women usually have less money than men and there are several

reasons. One is that women still tend to earn less money than men for

the same work. A possible solution is to ban pay secrecy: everyone

should be required to publish their income in the internet.

That

would also help reduce the gap between rich and poor.

Another reason why men tend to have more money is sexist inheritance

traditions. When parents die, many still tend to give more of their

estate to sons than to daughers. Scandalous but true. That should also

be published.

BIFT cannot address those two problems, but it can address another two:

First, women who decide to go back to work after having a child often

choose to work part time, to have more time for the family. In an ideal

feminist world, this would be no problem: men would do the same. But

there is another problem. In the current system, a part-time worker

doesn't earn much more than an unemployed person. The reason is the

welfare gap: unemployment benefits are means-tested, and benefits are

cut when income exceeds a given threshold. That makes it

hardly

worthwhile to work part-time. BIFT solves the problem..

Everyone

gets the basic income and it is never cut. No matter your income: the

more you work, the more money you have.

The second problem that BIFT addresses is that women tend to do more

unpaid family work than men. The solution is to remunerate childcaring.

BIFT does this indirectly by giving basic income to children

via

their parents. The rate for children is lower than for for adults, but

still more than the child support payments that parents

typically

get in the current system. Today, there is a high rate of poverty among

single mothers. BIFT could completely solve that problem. In fact, it

could eliminate poverty altogether.

What

would happen if our system of income tax and welfare payments followed

the graph?

Everyone

would receive a basic income. Most would receive the standard amount.

The disabled would get more, children would get less, and

there

might be special rates for pensioners. For illustration,

I have set the basic income in the graph to €1000 per month,

which

is where the straight line crosses the vertical axis. This

number is arbitrary. The exact amount would be

determined in a political process: the left would constantly want to

raise it and the right would keep trying to lower it.

Everyone

(rich, poor, and in between) would be motivated to work, because

everyone's income would go up at the same rate as they earned more

money. Any increase in income before BIFT (large, small, or in

between) would produce a corresponding

increase in income after BIFT. That is not the case in the

present system:

welfare recipients lose their benefit at some point as their income

increases (the

"welfare trap"). No wonder the unemployed sometimes give the impression

of not wanting to work! The fault is in the system, not the

people.

The

rate at which income after BIFT increases relative to income

before BIFT corresponds to the gradient of the graph. For purpose of

illustration, I have set

this rate to 50%. It corresponds to a 50%

income tax rate - similar to the highest tax brackets in current

progressive tax scales. If the old, corrupt tradition of tax deductions

was also ended (more of which below), a lower flat income tax rate

would be possible, perhaps 40% or even

30%.

That is a bargain if you consider that everyone would also receive the

basic income. The final rate would be determined by a political

process: the left would push for a higher tax rate, the right would

push for a lower one, and they would meet somewhere in the middle.

Both social welfare and income tax would be radically simplified,

improving transparency. The new system would be easier for everyone to

understand, especially those who cannot afford accountants; and easier

to adjust democratically, making it harder for politicians to trick

voters. For these reasons, both accountants and politicians may oppose

this idea, which is another reason why hardly anyone knows about

it.

Good

economics versus good ethics

BIFT boils down to two general principles:

1. No one should have to live in poverty. Everyone, rich or poor,

has the same

intrinsic value and the same basic needs.

2. Everyone should be able to keep a reasonable proportion of every

dollar they earn. Incentives

are important. The

system should motivate everyone to work.

The first point is socialist in nature and no-one but the most extreme

capitalist would dare to disagree it. The second point is capitalist in

nature and no-one but the most extreme communist would dare to

disagree with it. So just about everyone on both the left and

the right should agree with the present proposal, which is simply an

implementation of those two ideas.

Many economists will dismiss BIFT because it is not properly

embedded in economic literature. But the main two points that I am

making are ethical, not economic, in nature, and the economic

implications that I draw from them are direct and simple. The two

points are even included in the Universal Declaration of Human Rights:

1. Article 25 (1) states that "Everyone has the right to a standard of

living adequate for the health and well-being of himself and of his

family, including food, clothing, housing and medical care and

necessary social services, and the right to security in the event of

unemployment, sickness, disability, widowhood, old age or other lack of

livelihood in circumstances beyond his control." An unconditional

basic income is the simplest way of ensuring that this right is

respected.

2. According to Article 23 (3), "Everyone who works has the right to

just and favourable remuneration ensuring for himself and his family an

existence worthy of human dignity, and supplemented, if necessary, by

other means of social protection." This article implies that the more

or better one works, the higher one's income should become.

The economic literature on unconditional basic income is big, but

only a handful of articles and books considers the combination of basic

income and flat income tax. Those contributions tend to

be neutral

about its benefits (Atkinson, 1996; Scutella, 2004).

The authors attempt to evaluate the proposal by considering its

economic consequences: how will it affect the motivation to work,

economic growth, inflation, umemployment? The results of such

considerations are generally inconclusive and depend strongly on how

the two free parameters (basic income and tax rate) are set. But I

believe those articles are missing the point. The main point is

ethical, not economic: every human being has the right to

enough

money to survive and every human being has the right to keep a

reasonable fraction of each dollar earned.

Economists

may be curious about my economic qualifications. I never

studied economics, nor

have I published in an academic economics journal. Instead, I have many

frequently cited

academic

publications in related

disciplines (psychology, sociology)

and a

Master's degree in physics.

My everyday teaching and research in the interdisciplinary area known

as "systematic

musicology" also involves neuroscience, philosophy, computer science,

and philosophy

of science, all of which are

relevant to economics. I have a

strong interest in history, politics, ethics, and law.

New

ways of thinking

To understand BIFT, we need to radically change how we think about

income tax and welfare.

- People

are not only worth what they can

earn on the free market. People also have an intrinsic

value, which is the same for everyone. This is a universal socialist

principle.

- Welfare

traps are not intrinsic or unavoidable. They

can be completely avoided, and everyone can be motivated to work to the

same extent. This is a universal capitalist principle.

- Tax

and

welfare systems need not treat low and high income earners

differently. It is possible to treat everyone equally. This is

a universal democratic principle.

- A

flat income tax does not necessarily favor the rich at the

expense of the poor. The combination of flat income tax

and universal basic

income is progressive.

Depending on how the two parameters are

set, redistribution can occur in either direction: either from rich to

poor or from poor to rich. If the basic income corresponds to the

poverty line, poverty is eliminated.

- Poverty

is not natural or inevitable, nor is it the fault of the poor. It is

created by economic systems, and can be eliminated by changing economic

systems (Carter

& Barrett, 2006; Sachs, 2008).

Effective

progressivity

I am

a strong supporter of progressive taxation - a tried and

tested way to reduce the gap

between

rich and poor. The way the wealth gap is increasing today, progressive

taxation is more important than ever.

The above graph shows an effectively progressive

relationship. The tax paid, expressed as a percentage of gross income,

increases as gross income increases. At low incomes, the tax is

effectively negative (basic income is sometimes called "negative income

tax"). At medium incomes (€2000 in this example), a break-even pointis

reached where income before and after BIFT are the same. At

higher incomes, the

effective tax rate increases with income, approaching the flat rate for

very high incomes.

Here are

some examples, based on the arbitrary values of basic income and tax

rate in the graph. If you

earn €4000 before BIFT, your income after BIFT is

€3000 and your

effective tax rate, averaged over all earnings, is 25%. If you

earn €10 000 before BIFT per month, your income after BIFT is

6

000 and the effective tax rate is 40%. At very high incomes, the

effective tax rate approaches 50%. Recall that

all these figures are

tentative and approximate. The numbers would be adjusted in a political

process.

The system is progressive although the

line is straight ("flat tax"), because the line

does not pass through the origin. The offset from the origin is the

basic income. The bigger the offset, the more progressive the

system becomes. In a democratically regulated system, the left

would try to make the system more progressive by increasing

the

basic income, and the right would strive for the opposite.

We

have to stop thinking about income brackets. They are not

necessary to create progressivity!

Another way to create progressivity is to shift the line on the graph

so it no longer passes through the origin (the point where the two

axes intersect).

Difficulties

of

understanding

The

graph illustrates a simple mathematical relationship between

flat tax and progressive tax. To understand this proposal, you have to

understand this simple relationship. Unfortunately, many

don't. No

matter how long you try to explain it, they still don't get it.

Left-wingers may object to giving basic income to the rich. That is

missing the point.

The main thing is not the basic income, nor is it the tax rate. It is

the

relationship between income before and after BIFT. It is the

straight line on

the graph! It doesn't matter whether the rich get their basic income as

a payment or a tax deduction, because the result in the end is the

same, namely the line on the graph. In any case, the basic income that

the rich receive would be small compared to the tax they pay. It would

also be small compared to the tax deductions they normally get today.

The whole system of tax deductions is problematic and needs to be

phased out.

Right-wingers may object to giving basic income to the poor. That again

is missing the point. The unemployed are getting unemployment benefits

anyway. This proposal merely eliminates a bureacratic

system that is constantly trying to get the unemployed into jobs that

don't exist anyway. Those right-wingers who want to reduce the size of

government and make it more efficient should love this proposal, as

should all those who believe in preserving personal liberties and

preventing government interference in the private lives of citizens.

Moreover, technological advances mean that there is less work to do

than there used to be; trying to "create jobs" won't change that.

Besides, it doesn't help anyone when the unemployed have no money. They

are consumers and part of the market. You can't make money out of

selling to consumers if they haven't got any money.

You

can avoid the pitfalls of both the left and the right by trying to

stand in the middle and understand both sides. That can solve the

political bias problem. But there is another problem. Some people

cannot understanding the simplest of mathematical concepts, it seems,

such as how a simple graph works.

Imagine this: What

if our ability to eliminate poverty depended on a simple

mathematical idea? What if we failed to eliminate poverty because we

failed to understand that idea? Or refused to take that idea

seriously or give it a chance?

Conversely, what would happen if both the left and the

right suddenly realised that the elimination of poverty serves the

interests of

both, because welfare payments "trickle up" into markets? What if

both decided together

to implement a simple strategy that combines socialist and capitalist

principles? What if both jumped at the chance of reducing the

administrative load of both welfare and taxation? Imagine that: Freedom

from meaningless paperwork! Freedom from the stigma of unemployment!

Bringing

together

capitalism and socialism

You may be surprised to see a "capitalist principle" in a paper about

unconditional basic income. I am a lefty, but I am also self-critical.

Capitalism, for all its problems, is the motor that generates the

necessary finance. I also know that an idea like this will only work if

a majority of people support it. It so happens that half the population

tends to vote for the right wing, often against their personal

interests. To be successful, a proposal of this kind needs to balance

left and right wing ideologies. Left-wing friends: please don't stop

reading.

Humans have made big progress before. Slavery was banned, women got the

vote, human rights were signed into law. Now it is time to

eliminate poverty. We have taken a while to get

to this point - but we can now do it, by combining socialism

and

capitalism in the right kind of way. With the above graph in mind, the

task is easier than most people think.

Of course there will be other details to consider. For example, basic

income may be different for children, pensioners, the disabled, or

foreigners; and the tax rate may be different for income, capital

gains, and company tax. But the main point that I want to make is made

in the graph. The

graph is like the proverbial picture that paints a thousand

words.

The main points again

This idea is so great it is worth repeating the main points in a

different way. Here goes:

Both

welfare and income tax can

be radically simplified by combining them into a single system

called BIFT, which stands for (universal, unconditional) Basic

Income and Flat (income)

Tax. Under BIFT, the relationship between income

before and after BIFT is

a

straight line, as shown in the graph.

Basic

income is the point where the rising line

crosses the vertical axis. For the sake of argument I have set this at €1000/ month; the

exact amount would

have

to be determined in a

separate political process. Similarly, the flat tax rate has been

arbitrarily set at a round number, 50% - but it could be much less than

that if for example tax deductions were phased out and wealth, carbon

and transaction taxes were phased in.

Here is

how BIFT would work:

- If

you had no gross income, you would get the basic income. BI

would

replace all existing benefits for people who are unemployed, studying,

disabled, retired, or without local citizenship, probably with

different rates for different categories. Children would receive a

lower rate, disabled higher.

- If

you got a job, however large or small, or started earning money

independently, you would keep the basic income and all further income

(including capital gains) would be taxed at the same flat rate

(FT).

Too

good

to be true?

After

this tax

reform to end all tax reforms, the

relationship between income before and after tax/welfare for

individuals, which is what counts in the end,

would change remarkably little. At the same time, it would be possible

and

feasible to eliminate

the following:

- Welfare

traps, because people would

not lose their welfare as

their gross

income increased. Incentive would be independent of income.

- Welfare

fraud, because everyone

would receive "welfare" in the form of BI (also called

negative income

tax), and it would be linked to their ID card or passport.

- Income

tax evasion, because income

tax would generally be paid

immediately and

in full, with no later refund. Regular wage earners would not need to

wait until the end of the year. (Capital gains would still be

calculated yearly.)

- Yearly

income declarations for wage earners,

for the same reason.

Taxpayers, their advisers and

tax officers spend an enormous amount of time on this annual ritual.

This time would be saved.

- Precarity:

not only would people have the BI to fall back on if

everything else

went wrong, but also any additional casual or part-time work would be

protected by a contract. All wages and fees would be paid

electronically, just as the basic income is paid electronically.

- The

cash economy. Both

employers and employees would be required by law to ensure that all

wages are payed electronically and taxed immediately.

- Unfair wage structures. Wages

at the lower end, some of which are currently protected by minimum wage

legislation, would increase to reflect the true

value of the work (and the

people doing it).

- Poverty,

if BI was close to the poverty line (however calculated).

This would be the most important achievement. Poverty kills - in

developing countries, by hunger, disease, and violence, and in

industrial countries, by reducing life expectancy. It is hopefully a

truism that matters of life and death are more important than financial

matters.

BIFT

would also reduce the wealth

gap (between rich and poor)

and the gender

wealth gap

(between men and women) by eliminating poverty, improving disposal

income for part-time work relative to unemployment benefits,

effectively remunerating childcare through basic income for children,

and making it harder for the rich to evade or avoid tax.

Speaking

of tax evasion/avoidance, at the same time as introducing BIFT it may

be appropriate and opportune to phase out tax

deductions

to cover expenses associated with earning money (e.g. the cost of

setting up a business). The way tax deductions work in practice is

generally complex and unfair - they tend to favor

the rich.

The easiest and fairest solution may be to get rid of tax deductions

altogether. If the rich want a "free market", they should take

responsibility for their own investments and stop accepting

massive government rebates. That would allow the tax rate for

everyone to be reduced. BIFT could also work without changing

the current system of tax deductions.

Is this

list of benefits too

good to be true? Not really. The graph shows that these

benefits are mathematically

possible. They are also politically possible, because they would

benefit both poor and rich, left and right:

- The

left would celebrate the end of government interference in the lives of

the unemployed, and a system that is so complex that no-one understands

the whole thing, which ultimately benefits the rich because they can

afford the best tax advisors.

- The

right would celebrate the downsizing of government and the reduction of

both public and private administrative costs (paying tax advisors).

They would celebrate the end of welfare fraud, being recipients of

welfare themselves.

- Both

left and right would celebrate the end of demotivating welfare traps

and a return

to democracy:

the system would become publicly comprehensible, making

it possible to subject it to a democratic process whose

outcome benefits the majority of voters.

Eliminating

poverty would be the greatest achievement. Communism was

supposed

to do that, but failed; instead it made almost everyone poor.

Capitalism

pretends to be superior, but it too has failed to eliminate poverty.

Capitalists believe that every individual should have the right and

freedom to amass unlimited capital. From an ethical viewpoint, this

stance can only be acceptable if poverty is eliminated. BIFT

would

achieve this goal for the first time. It would take the guilt out of

being rich, and make capitalism more sustainable.

The end of the cash

economy

Things

are changing, but many people are still living in the past. Union

leaders and politicians are still dreaming of "full employment"

although we knew decades ago that technology would gradually reduce the

amount of work that had to be done, making unemployment unavoidable and

intrinsic. The solution is basic income. And we are still

defending the importance of the cash economy although, again for

technological reasons, cash is on the way out. In Sweden, for example,

people are seriously thinking of getting

rid of cash altogether, and

there are good arguments for that.

An

unconditional basic income would not be paid in cash. Everyone would

need a bank account. That being the case, it is also reasonable to

require by law that any further earnings must be registered

electronically in a bank account and taxed. The bank account should be

in the same country, of course - not a foreign tax haven (I

am assuming that law and order will be restored and tax

havens

eliminated by global agreement, but that is not a precondition for BIFT

to work). This way, everyone would be treated equally. The

unemployed would no longer be stigmatised. Low wages would increase to

reflect the true value of the work being done. The foreign cleaners in

middle- and upper-class homes, to take one example, would get proper

contracts, insurance and security.

Managing the transition

from the current

system to

BIFT

A

country that wanted to introduce BIFT would do so in

stages. They would first agree in principle to the idea of BIFT, by

which I mean a graph like the one above, with a straight line that does

not pass through the origin, but well above it. In the first stage they

would also agree that during a stepwise transition from the current

system to BIFT the relationship

between income before and after BIFT should change as little as

possible

(perhaps specifying limits on the size or rate of changes). The exact

level of basic income and the

exact rate

of incoine tax would then be determined in

a later process, after discussion between political parties, and guided

by economic advisors. It would be periodically adjusted in response to

changes in inflation and other economic circumstances.

A

sudden transition to BIFT is not possible because

of differences between social security systems in neighboring

countries. If basic income in a neighboring country suddenly becomes

very attractive, many people will try to migrate. This might be

prevented by giving different levels of basic income to nationals and

foreigners, but it may not be legally possible to give a different

level of basic income to nationals of different countries.

Take

the case of Austria. EU law would require that all EU citizens in

Austria get the same (higher) level of basic income and all non-EU

citizens get the same (lower) level. It is legally possible to

discriminate in favor of nationals and against foreigners, but not to

favor one group of foreigners over another group. Countries

within

the EU differ considerably in cost of living and average income.

The

solution might be to introduce basic income gradually. After each

incremental increase, evaluate the result for a year before introducing

the next increment. The transition to flat tax might also happen

incrementally. The transition would reduce differences in cost of

living between different EU countries, promoting European "unity in

diversity".

This

is clearly a complex issue that requires economic expertise that I do

not have. But the advantages of BIFT are surely clear enough that it

is worth investing time and effort into carefully designing and

monitoring a stepwise transition.

What is stopping this

simple idea from

catching on?

The

most puzzling aspect of this simple proposal is the failure (refusal?)

of many people to understand it. Most people, it seems, do not believe

that

things could be so simple. People on both sides of the political

spectrum are astonishingly reluctant to accept that their financial

dealings with the government are at present ridiculously complex and

unfair, and could be much more transparent, and

consequently much fairer. The left is reluctant to believe that a flat

rate of income tax becomes effectively

progressive when combined with a universal unconditional basic income.

They think there must be a trick - but there is none. The unions are

still dreaming of 100% employment when what their members really want

is enough money to live a decent life and fair remuneration for all

work done. The right refuses

to believe that the economy would get a boost if we gave

welfare

to everyone, no questions asked, but that again is a simple fact:

people are more likely to find work that they enjoy and become

productive if the government treats everyone with the same respect. The

right believes that giving away welfare will make people lazy, but the

reverse is the case: by eliminating welfare traps, the proposed system

would give a constant incentive to everyone to work harder or longer

regardless of their current income. The level of basic income would be

adjusted to simultaneously maximize incentive and minimize poverty by a

mathematical process of optimization.

In

academic circles, the failure of the idea to catch on may be related

to the failure of humanities and sciences to understand

each other (sometimes called the "two cultures" problem). Many

scientists have no idea, it seems, of the foundations of the humanities

(literature, the arts, history, anthropology) and many humanities

scholars can hardly tell you anything about the foundations of science

(basic mathematics, physics, chemistry, biology). The core of the BIFT

proposal is mathematical: it is about the quantitative

relationship between income before and after tax and welfare.

The

beauty and

elegance of the proposal lies in the simplicity of the proposed

relationship: a simple relationship is fair, efficient, transparent,

and hence democratic. BIFT is an example of philosophical principle

of parsimony known as Ockham's razor. Scientists intuitively apply this

principle when searching for simple reductionist explanations of

complex phenomena or datasets (physicists are still looking for a

grand general theory of everything, apparently).

Humanities

scholars

explicitly and enthusiastically contradict Ockham's razor when they

relish in the complexity of social,

historical, cultural or political phenomena. They point

out correctly

that one cannot possibly understand complex social phenomena without

becoming intimately acquainted with their detail. Many people who are

concerned

with problems surrounding poverty, and political or economic strategies

to reduce or eliminate it, were once students in humanities faculties

or traditions. They may have

no basic training in sciences at all, and consequently little idea of

how

scientists think. Their humanities-oriented brains may not

grasp the mathematical significance of the present proposal.

That

sounds negative and pessimistic, but there is also a positive side. One

of the points that distinguishes humanities from sciences is the role

of context. Claims made by humanities scholars are generally made

relative to a given social, historical, cultural or political context.

Claims are considered "true" only relative to such contexts - not in

any absolute sense. In other words, humanities scholars like to see the

big picture.

BIFT is

also about the big picture. To develop a fair public financial

system, it not enough to consider welfare by itself, or to consider

income tax by itself. It is necessary to consider both of these things

and their interaction. To understand BIFT, is not sufficient to

consider the rate of BI by itself, because the overall benefit

of BI

for individuals also depends on whether they retain or lose that income

when they earn additional income. It follows that BI may be

less than

current welfare rates, and recipients may still experience a net

benefit. Similarly, it is not enough to consider the flat tax

rate

by itself; the effective tax rate is what counts in the end,

and

that

depends on both the FT rate and the BI rate. Humanities

scholars who

are aware of the importance of seeing the big picture can surely

resonate to these ideas.

These

issues may become clearer if I explain some personal

background. I

came up with the idea of combining unconditional basic income with flat

income tax in the 1980s, when I was studying and researching on an

interdisciplinary PhD project combining music,

psychology and physics at the University of New England (Armidale NSW

Australia). As part of this project, I was working on some mathematical

modeling problems. The

challenge was to find the mathematically simplest model that accounted

best for a complex data set. By comparison to those problems, the

problem of how best to organise income tax and unemployment

benefits, and the solution I am proposing here,

seemed trivially

simple.

Perhaps

the failure to understand and communicate across the

humanities-science

boundary could be solved in the long term if all university students

learned the foundations of both humanities and sciences in their first

year - something along the venerable lines of the Humboldtian

model of higher education?

I experienced something like that when I was working at Keele

University in England in the 1990s ("foundation year"). But that would

be a long-term project, and it is beyond the present scope.

What

about economics? This academic discipline is highly

interdisciplinary, combining not only humanities and sciences, but also

theory and practice. The

first impulse of economists in response to the idea of combining

unconditional basic income with flat income tax may be consider a

comprehensive assessment in relation to the present system, and then to

answer the question: Would it really be better? That is an admirable

stance, but it is missing the point. It is surely obvious from the

above

simple description that the proposed system would be better. The

interesting questions are instead (i) how to explain to the general

public that this system would be better for everyone as well as for

society in general, which is a pedagogical and sociological question;

(ii) how to adjust the tax and welfare rates in the new system, which

would involve an interesting new interaction between economic expertise

and democratic process; and (iii) and how to manage the transition,

which is primarily a practical problem that involves the needs and

issues of specific interest groups and the relationship between social

benefits in nearby countries and the effect of introducing basic income

on migration. Questions of this kind are awaiting

attention by experts who care about

broad

issues of poverty, quality of life and democracy, and are prepared to

promote and defend a vision of a better society.

Myth no.1: Only rich

countries can afford an

unconditional basic income

Once

you understand BIFT, it seems obvious. You will ask yourself why we

have tolerated the current crazy system for so long, and why so few

people know about BIFT - let alone accept or promote it. It seems

that every time someone proposes something like it, people respond

with misleading counterarguments.

If

you dig deeper, you find the real reason for this behavior. People are

defending the right of the rich to get richer, in the hope of sharing

some of those riches - an impulse that may be driving a lot of economic

theory. Watch out for it!

Take

the idea that only rich countries can afford an unconditional basic

income. This is clearly not true. The proposal is to

reorganise

the existing system of welfare and taxation. In the long run, and

considering all aspects of the problem, the change may not cost

anything at all.

Let me

explain. Most countries have progressive tax scales. It is always

possible to

draw a graph of income before tax/welfare and income after tax/welfare

that applies to most

people, and is non-linear. Below are three examples. The exact numbers

are out of date (from the mid 2000s), but the basic shape of the curves

is correct.

In

every case, you can start from the highest tax bracket and draw a

straight from there to the vertical axis (the broken line in the

figure). The point at which it crosses the line is a first estimate of

the unconditional basic income. After that, you can slightly shift or

rotate the straight line

to balance the budget. For individuals, the relationship

between income before and after welfare/tax would change

remarkably little. This change could be made

immediately in most countries.

An

even better solution is to add some wealth tax into the equation.

Wealth tax will only work if the rates are similar

in

different countries, to stop capital flight. Clearly, our national

leaders should be trying to solve this problem at global

financial meetings. Other promising and neglected sources of revenue

are transaction taxes and carbon taxes. But the first point to be made

here is that

unconditional basic income can be introduced without any wealth taxes

at all.

Flat income tax: A crazy

right-wing dream?

Modern

income tax scales

are generally progressive.

People with higher incomes are supposed to pay higher proportions of

their incomes in

tax. There are several income "brackets" within which a different rate

of income tax applies. This idea is based on the general principle

that

taxes should be primarily paid by those who are in a good position to

pay them. The more you

can

pay,

the more

you should

pay.

Flat

tax is the opposite

of progressive tax.

In a flat-tax system, everyone pays the same rate of tax,

regardless of

their income. This is fundamentally unfair and tends to increase the

gap between rich and poor. In many countries, that gap has been

steadily increasing over the past few decades. It has become far, far

bigger than

it

should be, which is one of the causes of the "global financial crisis"

that we have been experiencing. If the rich paid more tax, national

governments could pay their debts.

I am

assuming that a gap

of some kind

between rich and poor is necessary to motivate people to work. But the

rich-poor gap does not have to be very big to

achieve

that goal. If the rich are ten times richer than the poor, by whatever

measure (income or wealth), the goal has surely been achieved. Perhaps

a ratio of only 2:1 would suffice. After the

gap reaches a certain size, increasing it further does not further

increase the incentive to work, because it is already near to

its maximum value. In scientific jargon we would say that

incentive saturates or approaches an asymptote. But in most

countries

today the gap is far bigger than 2:1 or even 10:1. The rich are

hundreds, thousands

or millions of times richer than the poor. However you measure the

ratio (by wealth or income, for example), it is far too big. For that

reason, a flat income tax of the

kind proposed by the far right is completely out of the

question.

But

still there are people out there who believe in flat tax. Why? There

are

two main reasons. First, they are

selfish: they want to

pay less tax although they are rolling in money. Second, they

habitually distort the truth: they claim that the poor are

poor

because they are lazy,

so they deserve to be poor. Evidently some people really believe this

to be true. In fact, no-one wants to be

poor, so of course the poor want to work and earn money - at least as

much as the rich. Poverty is created by economic systems, not by

individuals.

Unconditional basic

income and flat

income tax: A rational centre-left dream?

BIFT is

a surprising and radical approach to flat tax. I wish to show that

flat tax can be the solution

to

poverty, but only

when both

of the following

conditions are fulfilled:

- The

flat rate must be relatively high (e.g. 35 to 50% - instead of the 10

to 20%

commonly advocated by flat tax fans).

- The

flat income tax must be combined with an unconditional

basic income that corresponds approximately to the poverty line.

I

also wish to show that the

combination of

unconditional basic income and flat income tax is effectively

progressive. This is not a

political claim; it is a simple

mathematical

observation.

If that

is true, the

implications are

enormous. The political left now has the historic opportunity to eliminate

poverty -

not merely reduce

it. The

combination of

unconditional basic income and flat income tax (BIFT) is a path to

that goal.

BIFT is

about just one kind of tax: income tax. Another way to address poverty

is to

increase government revenue

through wealth, carbon and transaction taxes, which can then be

used to balance the budget and improve social

security. There

is an urgent

need to increase the level of all these taxes

at a global level. This article is also confined to industrial

countries but the basic principles may also applied to any country

(e.g. basic income could be financed globally through carbon credits).

I consider the

problem of poverty in developing countries in more detail elsewhere.

In

recent

years media and politicians have been presenting the "international

financial crisis" as a mysterious economic problem that only economists

can understand and only large payments of public money to private banks

can fix. But the basic problem is relatively straightforward. National

economies have fallen too far into debt. Governments have been living

beyond their means. Meanwhile, the rich have been getting richer. They

have been doing that in part by speculation on global markets that

should have been taxed, but was not. Of

course it is always possible to make governments more efficient, but

that will not make a big difference. It is also possible to regulate

markets, to some extent. But the most efficient and

appropriate solution in both cases is simply taxation. The rich should

pay more tax on wealth and income, and we urgently need tax on

international financial transactions and carbon. I will return to these

points

below.

The basic idea of BIFT

Below

is a graph of income before BIFT against

income after BIFT. If we are genuinely interested in eliminating

poverty, this is

the central relationship that we need to consider. In discussion of

this proposal it is important not to get sidetracked by considerations

of the separate rates

of tax and welfare. In the end, the separate tax and welfare rates are

not the primary

issue. What matters primarily

is the final relationship between income before and after

BIFT. As one

supermarket chain said in their advertisements, it is "total of the

tape"that counts, not the prices of individual products.

Under

BIFT, most peopl

would get the same

basic income, regardless of any other income. That is where the

diagonal line intersects the vertical axis. The value of €1000

per

month is arbitrary. It is a round figure that has been chosen

to simplify the calculation. Of course it would need to be

adjusted in a political process; it would depend on changing democratic

and financial constraints. If it is too low there is poverty, and if it

is too high the motivation to work is reduced.

Even the

rich would get

basic income, which is unconditional. But for

them

the amount of basic income would be small by comparison to the amount

of income tax. If we want to extract more money from the rich, we must

focus attention on the tax rate, not basic income. We must

also

simplify the taxation system

to make it more transparent and increase the chance that taxes will

be paid and not evaded or

avoided by cunning accountants. BIFT is a step in that direction,

but many other simplifications are possible.

The

amount

of basic income

would not be the same for everyone. The main exception is people with

disabilities that prevent them from working or reduce their ability to

work. Their basic income would be increased accordingly. Basic income

may also depend on age (children may get less, pensioners

more) .

On the whole, BIFT

would radically simplify social security payments. Many of the

bureacrats who

currently investigate the "willingness to work" of unemployed people

would find themselves unemployed.

Everyone

would pay the same

rate of tax on all gross income (FT). That is represented by the

gradient of the line in the graph. The lower the tax, the faster your

income after BIFT increases as your income before BIFT increases, and

the steeper

the line. For the purpose of argument and for drawing the graph, the

flat rate has been set at 50%. The exact value would be

determined

by democratic processes and financial constraints. It could be 40%, and

with

significant increases in wealth, inheritance and transaction taxes it

could even be 30%.

The

welfare trap

The

first thing to notice

about this graph

is that it is similar to the current relationship

between income

before tax/welfare and income after tax/welfare in modern democracies.

At the left end of the line, most people

get social security payments. In general, income after BIFT rises as

income before BIFT rises. The change from the current system to BIFT

would not

make much difference, if we simply drew a line of best fit through the

current relationship between income before and after welfare/tax for

the average

person, as it already exists in different countries.

But

there is an important

difference. In the

current system of

means-tested social

security and progressive income tax, the gradient of the line on the

graph is not constant. The line is not straight. That is partly because

of progressive tax scales, but there is a much bigger departure

from linearity at the so-called welfare trap. Currently, if you

are on welfare and start earning money, your welfare is reduced

accordingly. During this transition, your income before tax/welfare

increases

significantly, but your income after tax/welfare

increases little.

Depending on the system, your income after tax/welfare may stay the

same or even fall

as your income before tax/welfare rises. So it is not in your interest

to work!

There is no incentive.

The

welfare trap is an example of a poverty trap, because

it perpetuates

poverty. A

system that motivates people not to work is doomed to fail. The welfare

trap is inherent to all modern systems of means-tested social welfare

and progressive tax. This inherent fault is a guarantee that

these

systems will never eliminate poverty. Eliminating this problem

would be an important step toward

eliminating poverty.

Is BIFT fair?

At first

glance BIFT

seems unfair. We are used to a system of income tax and social security

in which different people are treated

differently. The system is periodically twigged before elections in

order to attract votes from particular groups. BIFT makes it

impossible to win elections this way. Everyone has to be treated

equally. If the rate of basic income is reduced, everyone is affected.

If the rate of tax is increased, everyone is affected. Is that fair?

Is it

fair to tax low

income earners at the same level as high income earners? Well, the

current system is even worse. Welfare traps mean that for incomes

between typical levels of social welfare and typical levels of

low-earning jobs, the effective

rate

of taxation is as high as 100%.

Every increase in income is taken away by reducing welfare payments.

From this point of view, BIFT is a big step forward for low-income

earners.

Is it

fair to give basic

income to the rich? In BIFT that is unavoidable because BIFT

avoids welfare traps. Not giving basic income to the rich would mean

finding a cutoff point below which basic income is paid. But that would

cause a welfare trap. Giving basic income to the rich is no problem

because the only

thing that

matters in the end is the relationship

between income before and after BIFT as shown on the graph.

Moreover, for the rich basic income is small compared to

income

tax.

How can

BIFT be

adjusted to reduce the gap between rich and poor? The solution

is

to increase basic income and at the same time increase the tax rate to

finance it. But this can only be done to a limited extent, because both

these actions reduce the incentive to work, which ultimately reduces

the total productivity and wealth of the country. To increase

productivity, it is necessary to reduce basic income and the tax rate,

but this again can only be done to a limited extent, otherwise the

incidence of poverty will increase. Between these extremes there is a

happy medium in which poverty is eliminated but a moderate rich-poor

gradient remains. If the electorate understands how BIFT works (and

it is certainly much simpler than the present system) that happy medium

can be found by regular democratic processes.

Its

simplicity and

transparency mean that BIFT is much fairer than the present system.

Everyone is treated equally and with dignity, and everyone is

encouraged to work. The rules are clear, and it is harder to break them.

Right-wing distortions

It is

common for

right-wing voters to claim or believe that the poor

are poor because they are lazy. In fact, the poor want to work just as

hard as the rich - probably more so because they need the money more.

It is the system that is causing poverty, not any assumed differences

in personality between the rich and the poor. Until the rich and the

right wing understand or admit this simple fact, there will be no

progress.

The idea

that poverty is

the fault of the poor is an old one. Before the French

revolution in the 18th

Century, it was common to believe in inherent differences between

rich and poor people, or between nobility and ordinary

people.

The

aristocracy somehow had aristocracy in their blood. The French

philosopher Rousseau was one of those who exposed this idea as nonsense

(e.g.

in his "Discourse on inequality"), and it was objections of this sort

that provoked

the French revolution, which of course changed the world. But crazy

ideas do not disappear overnight. The modern version of the nobility

fallacy is the idea that the poor are poor because they are lazy. Many

still seem to believe that if the poor only took advantage of

the opportunities that a free society offers them, they could

drag themselves out of poverty. We forget that everyone is born with

different opportunities and for this reason it is much easier for some

people to make

money than others. Statistically, there will always be large numbers of

people who fail to break through the poverty line. Unless we radically

change the system, that is.

The

stigma of unemployment

The

welfare trap is not

only a financial

problem, it is also a psychological and social one. Current systems

of

means-tested social welfare and progressive income tax create two

classes of people: employed and unemployed.

The employed have many freedoms that the unemployed do not have. The

unemployed are stigmatised. They get "handouts", which are

embarrassing.

They are made to feel like failures. They are given the impression that

they must be lazy or stupid or both. If they don't feel like working,

or lack confidence in their ability - no wonder.

These

fundamental

problems would be

eliminated by BIFT. Everyone would be treated equally. Everyone

would have the

same rights and obligations. Everyone would be equally

motivated to work. Everyone would also be free not to work, and take

responsibility for the consequences. The poor would be free to do what

the rich always

expected them to do, namely to drag themselves out of poverty. Just

imagine: a system that treats everyone equally, but at the same time

eliminates poverty. This is not a strange dream, but a realistic

solution to a big problem.

Of

course, the rich would

get a bit of a shock if these things actually happened. The

effect on their wealth would be minimal. The psychological effect would

be much greater. They

wouldn't feel so

special anymore, just like the

residents of West Berlin did not feel special any more after the wall

fell - no matter how much they had wanted to wall to fall.

Effectively

progressive income tax

Progressive

income tax

means that the rate

of income tax increases as income increases. The more you earn, the

higher the proportion of income that is taken away in tax.

BIFT is

not

progressive, because the tax rate is flat. But the following

table shows that it is effectively

progressive.

The

calculations are very

simple, based on a basic income of €1000 per month

and a

tax

rate

of 50%. These are round figures that have been chosen for convenience

and they figures would of course be changed if BIFT were

introduced.

The

table shows that when

you look at the relationship between income before and after

BIFT, the tax rate

effectively increases with increasing income. That is what I mean by

"effectively progressive". The higher your gross

income, the higher the effective

proportion of your gross income is paid in tax. In this regard, BIFT

is no different from the present system.

|

Monthly

income before BIFT (€/mo)

|

Monthly

income after BIFT (€/mo)

|

Effective

tax rate

|

|

0

|

1000

|

-infinity

|

|

1 000

|

1 500

|

-50%

|

|

2 000

|

2 000

|

0%

|

|

3 000

|

2 500

|

17%

|

|

4 000

|

3 000

|

25%

|

|

5 000

|

3 500

|

30%

|

|

10 000

|

6 000

|

40%

|

|

100 000

|

51 000

|

49%

|

A short history of income

tax and social security

Social

security and progressive income tax belong to the greatest achievements

of the workers' movements of the early 20th century. The

appalling poverty

produced by the industrial revolution was finally brought under

control, without resorting to communism. Poverty still existed, but it